Opinion: PPPs lead to dangerous debts for developing countries it’s time for the World Bank to act

Topics

For many years, public-private partnerships have been promoted by governments and financial institutions as a way to pay for development projects such as roads, schools and hospitals.

Eurodad

The World Bank is at the forefront of this push and advises governments on how to structure their PPPs. But it also ignores civil society campaigners’ concerns about the dangerous hidden debts that PPP projects can lead to.

The European Network on Debt and Development, and more than 75 nongovernmental organizations and trade unions from all over the world, will not participate in the World Bank’s public consultations on PPPs until this dangerous problem is tackled.

What are PPPs?PPPs are agreements in which the private sector essentially replaces governments as financier and/or provider of traditional public services. PPPs are not new in many developed countries and have faced criticism. In the past decade, their use has soared in developing countries.

World Bank figures show that investments in PPPs in developing countries increased by a factor of six, from $24.4 billion to $144 billion between 2004 and 2012. Despite a recent fall in investments, PPPs seem to be on the rise again, totalling $120.2 billion in 2015.

Proponents of PPPs argue that the private sector can deliver high-quality investments in infrastructure and reduce the need for the state to raise funds upfront. However, the evidence shows that PPPs can often be expensive and risky for the public purse.

So, why do countries go for this option instead of traditional public procurement? Eurodad research indicates that it’s not because of efficiency gains. Accounting practices allow nations to keep future costs and contingent liabilities off their national balance sheets, which means that the true cost of the projects remains hidden.

This is hugely attractive for many governments as they can then circumvent legislated budgetary limits and still deliver essential services without having to take into account the medium- and long-term implications of multimillion dollar projects.

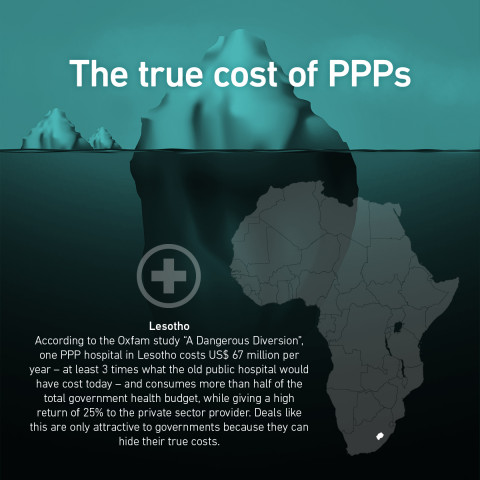

When PPPs go wrong for the public sectorThe fiscal implications of these projects can be enormous. PPPs have left lasting, costly legacies in countries such as Lesotho, Ghana, Tanzania, and even in developed countries such as Portugal and Hungary.

According to Oxfam, a PPP hospital in Lesotho — supported by the World Bank — eventually swallowed up half of the country’s health care budget while giving a high return of 25 percent to the private sector provider.

The European Commission warns against the “affordability illusion” that PPPs create, which tends to be exacerbated when a project is found to be “off balance sheet.” Experts at the International Monetary Fund also found that “governments often end up bearing more fiscal costs and risks than expected in the medium and longer term.”

The World Bank’s role in PPPsMeanwhile, the World Bank produces reports and guidelines on PPPs at a steady rate and continues to advise on and support PPP deals.

Some of the bank’s internal reviews have raised red flags. A 2014 report by the bank’s Independent Evaluation Group, which assesses the institution’s support to PPPs, indicated that hidden debts run up by PPPs are “rarely fully quantified” at the project level and “advice on how to manage fiscal implications from PPPs is rarely given.” The IEG acknowledged that the public sector liabilities triggered by PPPs can be “substantial,” which has often been the case.

Eurodad and many other civil society groups have responded to several reports produced by the World Bank, but the institution has largely ignored calls to address the dangerous accounting incentives behind PPPs.

The latest draft report from the World Bank — and the one that led to our boycott — is on PPP contractual provisions. Again, the bank fails to clarify how PPPs should be accounted for and, importantly, if it would support a project if the partner country decides to keep the costs and liabilities off the books. Given the bank’s development mandate, which is aimed at fighting poverty and promoting shared prosperity, failing to address the downfalls of PPPs is nothing short of scandalous.

The World Bank should explicitly call on countries to only opt for PPPs if their costs and liabilities are reported on balance sheet and registered as government debt. Otherwise, the private sector will reap all of the benefits and the public will be the ones that suffer when costs escalate and governments have to foot the bill.