Investment Protection

Topic category

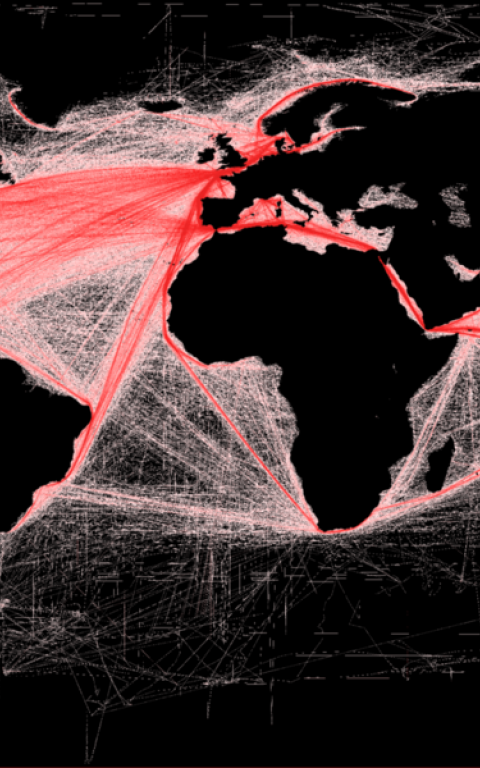

Investment protection mechanisms give corporations the right to sue states if they take any measures – including public interest legislation – that might threaten profits. Wellknown versions of this is the Investor state-dispute mechanism (ISDS) which after rising controversy and critisism has been replaced by the Investment court system (ICS). Investment protection mechanisms are included in most new FTAs. Nevertheless, several governments are starting to reconsider their commitments to it as they recognize the danger that it poses to their sovereignty. TNI has produced extensive research highlighting how investment protection gives corporations far-reaching rights that curtail governments’ sovereignty and drain limited public budgets. It has also revealed the big stakes the legal industry has in these mechanisms.

Latest

-

And Yet We Exist // Pero Sí Existimos : Online film premiere

Online eventEvent date and time: - CETEvent location: ZOOM -

The Impacts of Trade and Investment Policies on the Prospects for a Just Transition in Europe and the World

EventEvent date and time: - CETEvent location: ZOOM

Featured

-

The Financialisation of International Investment Law The landscape of financial profiteering from investor-state dispute settlement claims

Publication date:

-

The corporate assault on Honduras Mafia-style investments and the Honduran people’s struggle for democracy and dignity

Publication date:

-

Public Services in the Crosshairs The impacts of investment protection regimes on the public services sector in Latin America and the Caribbean

Publication date:

-

How Corporate Courts Threaten Our Future : Global ISDS Tracker

Publication date:

Key documents

-

Profiting from injustice How law firms, arbitrators and financiers are fuelling an investment arbitration boom

Publication date:

-

Red Carpet Courts 10 stories of how the rich and powerful hijacked justice

Publication date:

-

Profiting from Crisis How corporations and lawyers are scavenging profits from Europe’s crisis countries

Publication date:

-

RCEP: A secret deal Trade talks fail the transparency and public participation test

Publication date:

The Problem with Global Trade

Investment Protection, in conversation with Luciana Ghiotto

Many poor countries sign trade agreements with the desperate hope of attracting investment from their wealthy counterparts. However, these agreements, or treaties, tend to have some very problematic clauses, which often lead to trouble down the road. Investors have used these treaties to sue countries for any actions, such as changes in policy, that they perceive to be a threat to their projected profits. And they don’t sue in the national courts either, but in a special parallel system that seems to always favour the foreign investors. Countries have had to use billions in taxpayer money, to pay these investors, at the expense of their own development.