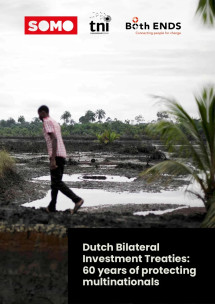

Dutch Bilateral Investment Treaties 60 years of protecting multinationals

This report examines the bilateral investment treaty network that the Netherlands has proactively crafted over the past 60 years and how the treaties have contributed to strengthening corporate power around the globe.

Download PDF

Authors

As a major offshore financial centre, the Netherlands has been a driving force behind the creation of a transnational legal space in which multinational corporations and billionaires move and store their globally extracted wealth. Dutch BITs have enabled foreign investors to claim a total of USD 105 billion in taxpayer money for different types of government regulations worldwide affecting the value of their assets. In particular, the legal form and complex structures that corporations have attained are the main mechanisms through which property claims are made to protect wealth and financial returns.

Notably, 71 per cent of the claims under Dutch BITs are filed by Special Purpose Entities that are owned and controlled by some of the largest corporations and the richest people in the world. The fossil fuel industry, in particular, has claimed a staggering USD 55 billion under Dutch BITs in compensation for government regulations in the oil and gas sector, of which USD 11.5 billion has already been paid out. These sums put huge financial pressure on governments across the globe and may divert public money reserved for clean energy transition programmes and alleviating energy poverty, as well as other crucial public services.

As the world faces huge and interconnected challenges, the termination of BITs and the abolition of ISDS should be crucial steps in dismantling the structural enablers of corporate power that inhibit the transition to equitable, democratic and environmentally sustainable societies.