There Are No Markets Anymore From Neoliberalism to Big Tech

Topics

Big Tech’s power is not just due to their size, but because they collect, control and monetise the very information we need for markets to function. They have become markets unto themselves. Reining them will require thinking that goes beyond regulation.

Illustration by Zoran Svilar

Google’s original motto was ‘don’t be evil’. Today, it struggles to live up to this noble principle, as a recent and ongoing court case brought against Google amply demonstrates. The most recent litigation document even states that ‘it seeks to ensure that Google won’t be evil anymore’. You may not have heard of this lawsuit, but it provides an important insight not only into Google but also into the whole edifice Big Tech has built up over the last decade or so, and which has gradually taken over our economies and undermined our markets.

The case against Google is being led by the State of Texas, along with 16 other US states. It is an antitrust suit called In Re: Google Digital Advertising Antitrust Litigation and was announced in 2020 by the Texas Attorney General, with its most recent amended version published in January 2022. It is running alongside a better-known antitrust case against Google brought by the US Justice Department at the end of 2020.

At the heart of In Re: Google Digital Advertising is the claim that Google is monopolising the technologies and market information underpinning online programmatic advertising, including the use of our personal data to try to sell us stuff. Programmatic advertising is a tangled beast of a system which Google sits astride as both buyer and seller of online advertising space. Similarly, Facebook (now Meta) sits at the centre of this online advertising market.

Here’s a quick description of how programmatic advertising works, and how this market has been exploited.

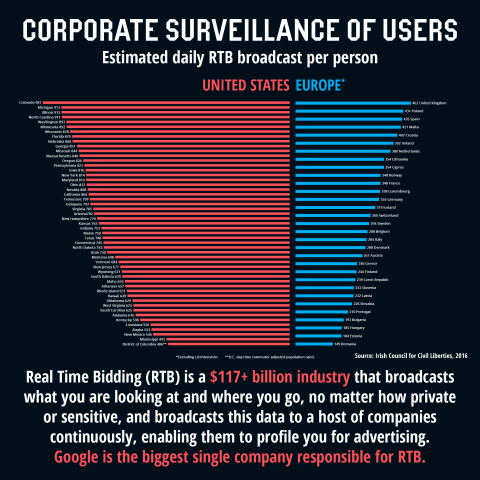

Let’s pretend you’re an advertiser: say you want to sell your book – although it could be any product or service – so you probably want to reach people who will actually buy it. Google offers to connect you to the online advertising space best suited to that purpose through its ‘ad exchange’. It does this by collecting and aggregating an enormous amount of our personal data from our searches, emails, smartphones, third parties using their analytics applications, and so on. We are largely unaware that we are handing over our personal data; it is hidden in the small print in the terms and conditions that most people simply sign in order to use digital products and services.

Using our personal data, Google can make inferences about our personal preferences – for instance, I like science fiction – and decisions – I’m likely to click on an online ad. With this information, they automate the buying and selling of adspace in the microseconds between our opening a webpage and seeing an advert. Google sells online adspace to you, the advertiser, to target your advert precisely at each viewer. A third party, such as a newspaper, sells adspace on its website to Google. In other words, Google both buys and sells adspace, also mediating between buyers and sellers through an auction exchange it controls – and from which it takes a cut.

Google basically overcharged advertisers and underpaid publishers by controlling the market-pricing technologies and architecture; they designed the market to benefit themselves and drive out competitors.

Travis Wise/Flickr/CC BY 2.0

The Texas lawsuit makes two critical allegations

- First, that Google and Facebook have colluded to monopolise the online advertising market, thereby excluding competitors from the market; this agreement was codenamed ‘Jedi Blue’.

- Second, that Google launched a secret programme in 2013 called ‘Project Bernanke’, allegedly designed to deceive advertisers and website publishers.

Project Bernanke revolves around Google’s design of the auction system used to buy and sell adspace.

Auctions can be designed in different ways. For example, auctions using sealed bids are often presented as a key feature of market competition because they enable market actors to reveal their true preferences without fear of being exploited or the system being gamed by other market actors. This is because no one sees the other bids until these are revealed at the end of the auction process; thus no one can change their bid in light of what other bidders are doing. Sealed bid auctions should, then, be the most efficient mechanism for determining ‘ideal’ prices in a market economy.

Economists have long sought to theorise the best design for auctions, with William Vickery famously winning a ‘Nobel’ Prize for his work on the benefits of second-price auctions, now called Vickery auctions. A second-price auction is designed to ensure that the highest bidder wins but also pays the second-highest bid, thereby incentivising bidders to reveal their true preferences (i.e. they won’t fear bidding too much). There are also third-price auctions, where the highest bidder will pay the third-highest price bid.

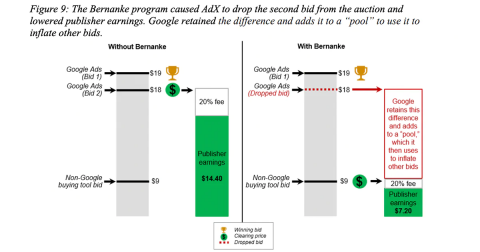

To return to Google and Project Bernanke. According to the Texas lawsuit, Google designed their ad exchange as second-price auctions, and told everyone that. However, according to the lawsuit, Google ‘surreptitiously switched Google’s AdX exchange from a second-price auction to a third-price auction on billions of impressions per month’.

Although this might sound complicated, it’s not. Basically, Google told advertisers that they would pay the second-highest bid, and told publishers they would be paid the second-highest price. It is alleged that in fact Project Bernanke changed the system so that publishers would receive the third-highest bid, while Google would net the difference. According to the claims, this meant that publishers lost up to 40% of their revenues as a result, but knew nothing about it. Google then ‘pooled’ these extra revenues and used them to ‘inflate the bids of advertisers bidding through Google Ads to help them win impressions they would have otherwise lost to advertisers bidding through non-Google buying tools’.

As one commentator noted, Google basically overcharged advertisers and underpaid publishers by controlling the market-pricing technologies and architecture; they designed the market to benefit themselves and drive out competitors.

Source: p.107, https://www.documentcloud.org/documents/21179902-3rd-complaint-for-texas-google-antitrust-case

Markets and the Long Tail of Neoliberalism

The takeaway from all of this is that their control over digital platforms enable Big Tech firms like Google to design markets in ways that best suit them. The lack of transparency in these platforms means that markets can deviate quite significantly from the assumptions of pro-market thinkers and policy-makers who have dominated how we understand economies and societies since the 1970s.

Often defined as ‘neoliberalism’, the underlying assumptions of this worldview can be described as a political-economic and moral project to redesign societies to put markets at the centre of decision-making, whether by governments, organisations, or individuals. Harking back to the work of thinkers like Friedrich Hayek – the famous peripatetic Austrian economist – neoliberalism is premised on the idea that no one agency (e.g. government) can coordinate the economy or society because it lacks the cognitive capacity to process all the information we individually produce and use to make everyday decisions. For Hayek and other neoliberals, markets are the best information processors for efficiently coordinating our societies. As Hayek put it:

‘The reason for this [economic problem] is that the “data” from which the economic calculus starts are never for the whole society “given” to a single mind which could work out the implications and can never be so given’.

Hence, markets are the best way to coordinate society since they can provide us with information to make the right decisions. They do this through the price mechanism, where prices are proxies for information telling us what and when to produce, when to change our preferences, and how best to manage our collective resources. Markets are, in this framing, both a factual and a moral mechanism; they tell us how to decide and what decisions are best to make.

Within this neoliberal narrative, information becomes a critical component in the working of markets. People cannot reveal their preferences or make decisions without information. Since Hayek, the problem of information permeates much orthodox economic thinking. However, it is precisely in neoliberal thinking about information that its assumptions about markets start to come unstuck. This is because, at least in the policy and legal spheres, neoliberal thought gradually shifted from Hayek’s view that societies will gradually evolve towards markets and market thinking to a perspective in which societies are simply assumed to operate like markets with everyone behaving as if they are market actors responding to incentives, defined by prices as proxies for information.

This is wonderfully outlined by S.M. Amadae in her book Prisoners of Reason. Her basic argument is that the goal of neoliberal thought and policy-making is that once you have worked out what markets should do, then you no longer need to let markets emerge spontaneously, in a Hayekian fashion. Rather, you can design markets to achieve what they need to do to achieve your desired policy outcome.

And this is exactly what happened; the various ideas about market or mechanism design – like second-price auctions – became wedded to assumptions about what our individual and collective goals should be so that policy-makers could design markets to that end. So, when governments seek to privatise public assets, or deregulate electricity supply, or auction off radio or cell phone spectrum, they use mechanism design. Results are varied, sometimes generating enormous government revenues (e.g. UK G3 spectrum licensing), but sometimes leading to significant problems (e.g. Californian electricity deregulation).

Such market or mechanism design has a relatively short history, going back to work by economists like Vickery in the 1960s, but it was not until the 1980s when it really took off and became a staple of policy-making. Second- and third-price auctions, explained above, are an example of how to design markets; such auctions are configured by the assumption that we are rational and self-interested beings who seek to maximise our own interests, which in turn will generate collective, social benefits. For example, cell phone spectrum auctions are supposed to generate as much government revenue as possible, while not discouraging innovation.

The key, then, is to create market mechanisms that get us to reveal our preferences through the design of ‘choice architectures’, like auctions, ensuring that we are always truthful about our desires in making our choices. Many contemporary conceptions of markets – and not just the neoliberal version – depend on this idea that markets reveal information upon which we can all act as individuals, without the (assumed) distorting interference from a central planner (e.g. government). Market design, however, actually turns all of this on its head. Market designers can create whatever markets they want to achieve whatever outcomes they want; individual preferences and decisions are sidelined here, since market designers can construct whatever market architecture they need to incentivise us to do what they want (e.g. increase revenues, welfare, or efficiency).

As critics, myself included, debated whether neoliberalism was dead, dying, or resurgent after the 2008 global financial crisis, Big Tech simply rode the wave of easy money unleashed by central banks through quantitative easing to establish themselves as the dominant players in our economies.

The Ascendance of Big Tech

Until relatively recently, it wasn’t really possible to extend market design beyond a particular goal or outcome. All of this changed, however, with the rise of Big Tech firms, such as Apple, Amazon, Alphabet/Google, Microsoft, and Meta/Facebook. They have transformed the way our economies and societies function and, increasingly, dysfunction – such as fears about misinformation, cognitive impacts, dark patterns, and such like. I shall return to some of these later.

Today, it is safe to say that Big Tech are the key intermediaries in our daily lives and the information on which we rely: they connect us to one another, they operate the infrastructure we use for work and leisure, they provide us with useful goods and services, and far more besides. Much of this mediation relies upon digital platforms, such as those that match you with others (e.g. Uber), with content (e.g. YouTube), or with ads (e.g. Facebook/Meta). Obviously, they don’t do this out of the goodness of their heart; they take personal, commercial, and user data from us in exchange for what they provide, which they then turn into further products, services, and infrastructures.

Increasingly, they have designed and reconfigured their technologies, such as digital platforms or application programming interfaces, with the specific goal of collecting increasing amounts of our data, as they have become dependent upon their data enclaves for their success. These enclaves represent the data holdings created by the spreading of Big Tech’s influence through their ecosystem of devices, applications, software, and platforms.

It is hard to comprehend the sheer size of Big Tech, to get a good sense of how their existence makes such a difference in our lives compared with other companies. Until recently, Big Tech were among five of the world’s largest companies by market capitalisation at over US$5 trillion in 2020, representing almost 25% of the total market capitalisation of the US stock market. They have since fallen in market terms, but not because they have become any less important to our lives. According to a 2020 report resulting from an investigation by the US Congress, 81% of all general searches and 94% of all mobile searches use Google; 99% of smartphones use Android or iPhone operating systems; 80% of browsers are either Google Chrome or Apple Safari; Facebook, Instagram, Messenger, and WhatsApp have 2.47 billion daily active users between them; an estimated 50% of all US e-commerce goes through Amazon; and Amazon, Microsoft, and Google dominate cloud computing infrastructure. Big Tech is so ubiquitous that it is now hard to live without them.

Source: https://journals.sagepub.com/doi/full/10.1177/20539517211017308

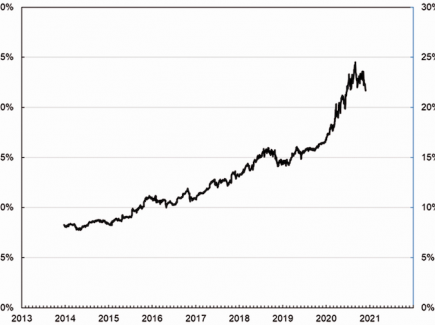

As critics, myself included, debated whether neoliberalism was dead, dying, or resurgent after the 2008 global financial crisis, Big Tech simply rode the wave of easy money unleashed by central banks through quantitative easing to establish themselves as the dominant players in our economies. This was especially true in the US where the Federal Reserve released more money between and 2008 and 2010 than in its previous 95 years’ existence. The journalist Christopher Leonard outlines the unintended and negative consequences of this policy in The Lords of Easy Money. As he points out, this flow of easy money resulted in a decade-long low interest rate regime – only stalling with the recent rise of inflation – in which central bankers had hoped companies would leverage the cheap money to invest in new assets and jobs. Few did, preferring instead to use the money for share buybacks or investments in asset bubbles, including the booming tech industry, which saw spectacular growth in venture capital funding.

In contrast, Big Tech put that easy money to good use, especially increasing their stock of tangible assets like data centres, high-speed cables, and suchlike, enabling them to expand their data-collection activities and the computing capacity needed to turn that data into value and cement their market power. Amazon, Google, and Facebook (Meta), in particular, significantly increased the share of tangible assets on their balance sheets.

The real kicker to all this, though, comes with the digitalisation of market design ushered in by the ascendance of Big Tech firms and their platform ecosystems. As Salomé Viljoen, Jake Goldenfein, and Lee McGuigan point out, market design has been turbo-charged by algorithmic technologies enabled by the mass collection of personal data and vast computing capacity of Big Tech firms. They discuss how ‘algorithmic or automated mechanism design’ gives Big Tech firms a special and unprecedented ability to profile their users, customers, suppliers, and others.

Rather than worrying about policy outcomes, Big Tech has applied mechanism design to making money, as my starting example illustrates, across their various platforms and ecosystems. They are using mechanism design to incentivise particular kinds of user engagement and impressions with and within their ecosystems, encouraging us to spend more time using their products and services.

As user experience designers note, something as simple as constant scrolling, a defining feature of platforms like Facebook, Twitter, and Instagram, was designed and implemented precisely because companies knew it leads to addictive-like behaviour, keeping our attention glued to our screens; the same applies to notifications, ‘likes’, and other technologies of digital engagement. And the more time and attention we pay to our screens, the more value Big Tech can capture from our behaviour. By designing markets in this way, Viljoen and colleagues argue that Big Tech is able both to cultivate and exploit so-called ‘informational asymmetries’, meaning the information that Big Tech has but their users do not.

Challenging Big Tech?

Because of their social and market power, Big Tech are currently facing growing challenges to their dominance. Some of these are collective challenges, but others are emerging from the inherent and internal contradictions in their own strategies and operations.

The Texas lawsuit mentioned at the start is just one of many collective actions being brought against Big Tech, both by governments and competitors. More concerted efforts have been undertaken by sovereign jurisdictions to rein in Big Tech’s power, some of which appear more effective than others. The European Union (EU), in particular, has been active in this area as concerns about Big Tech’s anti-competitive impacts have grown. Recently, the EU has introduced various policies and regulations, including:

- Digital Markets Act establishing ex ante regulations to control the behaviour of so-called ‘gatekeeper’ firms like Big Tech. It forbids certain actions like combining personal data from platforms with data collected for other services. It comes into effect in 2023;

- Digital Services Act designed to increase transparency in online advertising while reducing illegal content and misinformation. It comes into force in 2024; and,

- Data Governance Act to open up and standardise data sharing between organisations, limiting the ability of companies to hoard data. It is still in the legislative phase.

Other countries and jurisdictions are also taking action, such as Australia and the US, although there is stiff lobbying from Big Tech and other data-driven companies.

A different challenge, though, seems to be emerging from within the Big Tech firms themselves, namely the growing contradictory effects arising from their operations and strategies. As anyone who has used their products and services knows, Big Tech’s offerings are becoming much less useful, and even dysfunctional. My personal experiences include: buying dodgy products via Amazon that are knockoffs or scams; using Google search but having to scroll halfway down the page to avoid advertising; browsing through Facebook but being put off by all the advertising (Knights Templar T-shirts anyone?); having to change settings on Microsoft products because of some bizarre automated effect; and avoiding Apple like the plague because I do not want to be locked into an enclave.

Others are having similar experiences – data-driven companies are finding it harder to achieve their stated goals: for example, ride-hailing companies like Uber and Lyft are having to raise prices to the same or higher levels as taxi companies; food-delivery companies like Doordash or Deliveroo have been undermining the restaurants they rely upon for their very existence; and Airbnb is plagued by scams and is transforming housing markets in problematic ways. And don’t even get me started on things like ‘click farms’.

Generally, we need to find ways to limit the collection and use of our personal data and I think there’s a growing political space to do this as data-driven firms encounter a growing range of problems with their business and innovation models. We have options. One way is to channel pro-market sentiments by turning our personal data into our property – which will probably not solve anything no matter how attractive it might sound since it is difficult to determine who should own what information. Another option is to create centralised data trusts, perhaps run by governments or public agencies, providing access to all sorts of digital data while providing oversight of its use – this might help solve some issues and open up our data to uses for with which we agree, but would not necessarily stop Big Tech from accessing our personal information. A third option is to create decentralised data cooperatives or data communes, collectivising our personal data and enabling more local oversight and accountability – these could be run by specific groups, organisations, or communities, but would require significant effort to run and manage all the privacy concerns that people have about their personal data.

One thing is certain: we are going to see far more digital data in our lives, and if we want to use it for our collective benefit then we need to find ways to govern it collectively and democratically, rather than leave it in the hands of powerful corporations to do with as they will.

To Conclude ….

Market design has underpinned the ascendance of Big Tech firms over the last decade or so. A new array of digital and algorithmic technologies have enabled these and other data-driven firms to monetise the very information on which markets are supposedly dependent (e.g. who wants to buy X, what person Y would pay for Z, how many people view A); this market information is meant to be transparent and truthful to ensure competition, but it is increasingly hoarded and hidden in data enclaves constructed by Big Tech firms to secure their monopolistic positions. So, rather than simply monetising personal information, Big Tech firms have gone far beyond the ‘surveillance’ fears of many critical thinkers, such as Shoshana Zuboff.

Today, however, Big Tech firms face challenges on different fronts: from politicians and policy-makers developing new frameworks to curtail their power; and from the internal contradictions and dysfunctions in their own operations. All of this raises the question: will markets come back with a vengeance, or is this the start of something new? An important point for activists, civil society groups, non-government organisations (NGOs), and publics to remember when raising awareness or engaging with governments about the power of Big Tech is that if there are no longer any markets, then regulators returning to their outdated ways of understanding the world to rein in Big Tech will not work. We have to think beyond the market.