The Netherlands: A welfare state for the fossil fuel industry

While for many people the cost of living is rising while wages are lagging behind, fossil fuel companies are getting abundant support from the government. How much support do these fossil companies get and in which form(s)? And what can we do to change this and initiate a fair transition to a fossil-free future?

Michelle Tylicki

Fossil fuel companies are receiving billions of euros in subsidies from the Dutch government. In addition, as the Netherlands are de facto a tax haven, they barely pay any taxes on their billion-euro profits.

This stands in stark contrast to fast-rising prices and lagging wages. A growing number of people are struggling to make ends meet at the end of the month. Where someone on benefits is expected to account for every bag of groceries, the Tax Administration extends massive discounts to fossil multinationals.

In this article, we explain how this works and what we can do to ensure that the transition to a fossil-free future is a fair one.

Billions in subsidies

€37.5 billion euros. That is the amount that the Dutch state extends to the fossil industry, according to new research by SOMO, Oil Change International and Milieudefensie/Friends of the Earth Netherlands. No wonder that the energy transition has barely materialised in the Netherlands. Thanks to, among other things, this state support, the outdated revenue model of gas and oil is too lucrative to throw overboard.

What does this state support comprise? It includes a tax break on the gas use of big companies. In 2019, household paid 21 times more tax per cubic metre of gas than corporate industry (€ 42 cents compared to 2 cents). For every kilowatt hour of electricity, households paid 11 cents in tax compared to 1 cent for these bulk consumers.

In addition, large companies do not pay tax on fossil fuels used for energy generation. Plus, there is a tax discount on oil refining. This is (part of) the reason why two of the largest refineries in Europe, Shell's Pernis and BP's Europoort, are located in the Netherlands.

The goal to lure in energy-intensive industries to our country with these tax breaks has been achieved. Except we are now saddled with an industry that emits large amounts of CO2 and is barely making any effort to become more sustainable.

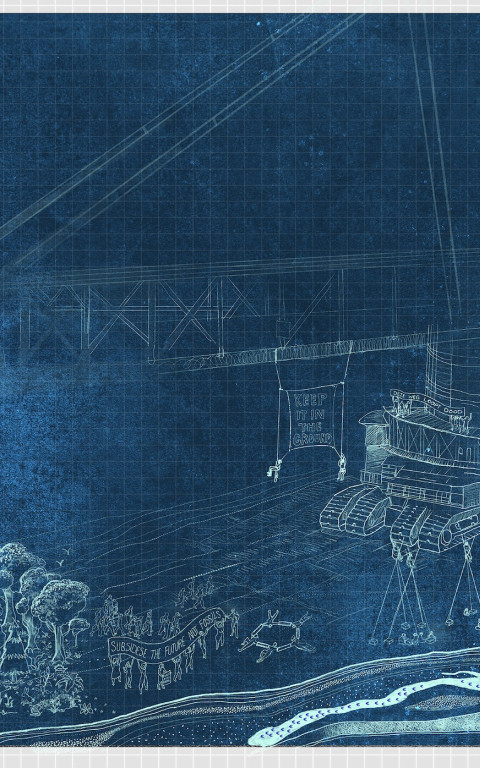

Fortunately, a rapidly growing climate movement is, in a variety of ways, demanding an end to this cossetting of the fossil industry and such actions will remain necessary until the policy has changed fundamentally.

The Netherlands – a tax haven

The Netherlands, together with the Virgin Islands, the Cayman Islands and Bermuda, is the most important tax haven in the world. According to the OECD, this involves 427 billion euro in lost income worldwide. In July 2023, it became clear governments are being deprived of 46 billion per year because of the Netherlands as a tax haven. Our country is a crucial linchpin in the world-wide web spun by fossil fuel companies to avoid taxes. The five largest fossil companies have administratively established over one hundred subsidiaries in the Netherlands. By shifting profits between business units, they evade taxes.

The tax authorities are offering them red-carpet treatment. Secret agreements (so-called rulings) make for very substantial discounts on tax payments. For example, for a long time, Shell, as a former Dutch company, paid no tax at all on its profits, thanks to a combination of creative accounting and secret deals with the tax authorities. For more on this, see Taxjustice.nl

Insurer for the construction of oil pipelines and gas ports

For years, the Netherlands has facilitated fossil energy projects by means of export credit insurance. According to environmental organisation BothEnds, this involved €1 billion per year in support for the fossil industry between 2012 and 2021.

At the COP 26 climate conference in 2021, the Netherlands announced it would stop this support before the end of 2022, but ultimately took a year longer. This must definitively end by 2024, including the loopholes in the policy. We will hold the new government to this.

A fair transition is possible!

Imagine how much easier the just transition will become when the Netherlands stops being a welfare state for the fossil industry: no more billion euro claims from polluting companies, no risk insurance for new pipelines, no tax benefits for polluting industries.

Thirty billion euros becoming instantly available for a just transition. For things like free public transport, support for insulating houses, retraining funds for people currently working in the fossil sector and money for installing sustainable energy. And of course, compensation for affected communities in (the north of) the Netherlands and the Global South, where the impacts of climate change are most strongly felt.

Join rallies, take action, vote for parties who aim to end fossil subsidies, read and learn about the strategies deployed by the fossil sector via the reading links and support the campaign against Bilateral Investment Treaties via handelanders.nl/bits

Join the actions

Join rallies, take action, vote for parties who aim to end fossil subsidies, read and learn about the strategies deployed by the fossil sector via the reading links (in Dutch) and support the campaign against Bilateral Investment Treaties via handelanders.nl/bits