The Bail Out Business Who profits from bank rescues in the EU?

The Bail Out Business is the most comprehensive and thorough analysis of the response to the 2008 financial crisis to understand who benefits from rescue packages in the EU. How effective were the bail out measures? What were the hidden costs to the taxpayer? and what was the role of the Big Four (audit firms) and financial consultancy firms in the business of designing and implementing bail out programs in EU Member States?

Descargas

Autores

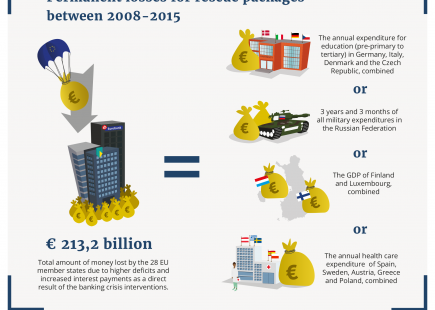

Bail outs in the EU have a hidden cost for taxpayers. On top of the public money used for the bail outs, contracts worth hundreds of millions of Euro have been given to a small number of financial consultants to advise member states and EU institutions.

The so-called Big Four audit firms (EY, Deloitte, KPMG and PWC), with a small coterie of financial advisors, have designed the bloc's most important rescue packages. Bail out consultants have also been rewarded with new business, even though many gave poor advice or failed to raise the alarm at crucial moments.

For years we have been investigating austerity measures and vast privatisation programmes in Europe. Following our last report on the privatising industry in Europe we decided to hone in on those firms involved in the numerous EU bail out programmes and found a shockingly similar pattern. The Bail-out Business reveals the hidden costs of the rescue packages and a troubling array of conflicts of interest.

Correction 23/2/2017: Lazard was paid 3 million euros for a few days work

Watch the video:

Click the infographics for a bigger version.

Karen Paalman

Did you enjoy this content? Then please consider supporting TNI.

Support our crucial research and help us to work on the critical issues of our time. We work at the crossroads of movements, activists, policy makers and scholars to enhance public debate and turn ideas into movement. Become a supporter now.