Titanic Encounters Geopolitics at the centre of energy transitions in the Sri Lanka

Topics

Regions

Sri Lanka’s attempts to transition its energy system have been undermined by geopolitical competition, particularly between China and India, that have exploited the South Asian country’s weak neoliberal state and increased control of its energy infrastructure and economy.

Illustration by Matt Rota©

History of China’s and India’s involvement in Sri Lanka’s energy system

For two decades, Sri Lanka’s energy policy has been shaped strongly by China and India, which are now regional leaders in energy infrastructure, technologies, and financing. Sri Lanka’s strategic geographic location has made it particularly vulnerable to geopolitical interests and competition.

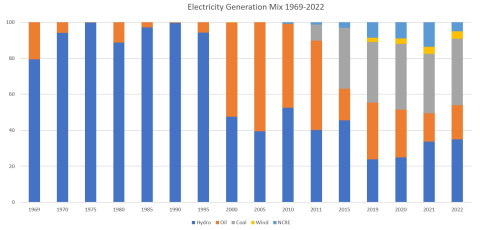

As a lower-middle-income country in South Asia, Sri Lanka has been keen to increase its energy supply in the face of rising energy demand, unstable hydropower production due to climate change, and a lack of public finance and the reluctance of the private sector that makes it hard to start new projects. The country’s energy mix has changed over the years and fossil fuels have gradually displaced hydropower as the major energy source (see Figure 1).

This situation compelled the country to seek external engagement in the energy sector from the late 1990s. As stated earlier, three regional powers have become especially influential in Sri Lanka’s energy politics: neighbouring India, the emerging power China and its longstanding development partner Japan, each of which entered the country’s energy system with specific interests and competences.

Complied by authors using multiple reports. Mainly Central Bank of Sri Lanka annual reports and CEB annual reports.

India is now the world’s second-largest importer and third-largest refiner of crude petroleum, the second-largest producer of coal, and the fourth-largest producer of wind and solar power.2 China is the world’s largest producer of coal, and the largest consumer and importer of energy.3 It is also a significant producer of energy technology and other associated commodities, and thus has global impact on energy markets and trade.4 China’s green technology industry is increasingly recognising the potential for growth in South Asia and has become a major energy player in the region through project investments and as an energy exporter.

Japan has supported the Sri Lankan energy sector since the early 1970s through its development cooperation and technical assistance to enhance the energy system by modernising grids. It offered to build a coal power plant in 1995, but this did not materialise. In 2006, China also offered to build a coal power plant, and it became operational in 2011. In the same year, India was offered a coal power plant project through a Sri Lanka–India agreement. This project was met with environmental protests, and eventually the ‘Green Trincomalee’ social movement managed to stop the coal plant through the Supreme Court ruling in 2016 (see Box 1).

Box 1: Opposition to coal-fired energy plants In December 2006, the Sri Lankan government and the Indian company National Thermal Power Corporation (NTPC) signed a Memorandum of Understanding (MoU) to build a 500 megawatt (MW) coal power plant in Sampoor in the Eastern Province. At that time, the area was controlled by the Liberation Tigers of Tamil Eelam (LTTE). In 2008, following the resurgence of the civil war, the LTTE was eliminated from the area, which was subsequently demarcated as a High-Security Zone. People who were evicted from their lands in the area were not allowed to return and were still more distressed by the announcement that the coal power plant was to be constructed there. A local social movement, ‘Green Trincomalee’, mobilised support across the country, citing environmental and social concerns. Despite the protests, India continued work on building the plant until, eventually, a Supreme Court order stopped the construction. |

These external engagements in Sri Lanka’s energy sector, promoting non-renewable sources of energy, have contributed to creating a domestic environment that is favourable to carbon lock-in, including corruption. The Chinese-funded coal plant is a prime example, where coal tenders have continuously mired in charges of corruption.

Multiple reports have found that massive amounts of money have been misappropriated.5 Investments in fossil infrastructure facilities the Ceylon Electricity Board’s agenda for continued reliance on fossil fuels, potentially delaying the adoption of low-carbon technology and the deployment of economically viable renewables.6 Another recent example of investments enhancing carbon lock-in is China acquiring rights to build an oil refinery at the Hambantota International Port. Even though it is claimed to be export-oriented, it is expected that it will be used for imports that will deepen Sri Lanka’s energy dependence on oil.

Sri Lanka’s path to renewables and its geopolitical challenges

Sri Lanka pledged its commitment to reducing carbon emissions under the Paris Agreement, which means that it faces the challenge of making the transition to renewable energy. This transition to a cleaner energy system will bring about fundamental and systemic shifts affecting governance, policy, trade and innovation. In reality, however, Sri Lanka remains and is increasingly dependent on carbon-based non-renewable forms of energy, and both domestic power dynamics and the energy geopolitics of India, China and Japan pose the risk of increased carbon dependencies and energy vulnerabilities.

Sri Lanka’s plans to move to clean energy are politically and socially complex. Since the mid-1990s, the country’s energy demand has been increasing. As it has maximised its hydropower sources, this has created a demand for new energy sources and the government has invited external assistance to develop new energy sources through technology, resources and financing, making renewable energy a new battleground for regional powers.

In 2021, for example, a Chinese company won the bid to construct a hybrid renewable energy facility in the two islands in the northern part of Sri Lanka, which lie in close proximity to India. India was unhappy that a Chinese company had won the tender, since it viewed allowing a Chinese company to build a renewable facility close to its territory as posing a national security threat. After a year-long battle, India succeeding in having the tender cancelled, and eventually offered a loan to build the renewable energy facilities. This outcome illustrates that Sri Lanka’s decision-making power in the energy sector, including the necessary transition to renewable energy, is deeply entangled in geopolitics.

A policymaker who was part of the process described it as follows in the following way:

Over the past decade, we have lost energy independence, and now we do not have energy sovereignty. Indecisive political leadership, the fluidity of interest-based policymaking has put our energy future in the hands of external actors. Even though, as a nation, we want to move to renewables, who drives it has become an issue where we cannot pick and choose. The geopolitics unfolded over the renewable projects in the islands in the North indicates the power of geopolitics and the dangers it presents and the precedence it sets for the future.7

If the Sri Lankan state is sidelined, this is even more true of the communities most affected by energy projects. In 2022, the Indian company NTPC, in a joint venture with CEB, agreed to build a 1300 MW solar plant in an area previously designated for the coal plant. For the local population, which had been displaced by war, this meant that an external actor would be grabbing their land for the sake of advancing the green energy transition, but with no meaningful consultation or compensation with them. One local activist8 said:

The people who are evicted from the lands are still refuged. They are still suffering. They must be allowed to return to their village and their lands. After so much protest, the governments of India and Sri Lanka still fail to understand the socio-economic and environmental concerns. People are always at the bottom of the decision-making protest, and our voices are always unheard.

What these and other examples indicate is that the transition to green energy is becoming a new arena for geopolitics, alongside the competition between different regional powers over traditional carbon-based forms of energy.

2022 economic crisis increases external dependency

The 2022 economic crisis has aggravated this geopolitical competition and has opened new avenues and opportunities for engagement in the Sri Lankan energy sector. One policymaker summarised Sri Lanka’s difficulty by simply stating that ‘beggars can’t be choosers’.

In August 2023, six bilateral energy agreements were signed during the Sri Lankan presidential visit to India. The agreements encompassed a range of initiatives, such as the proposed establishment of an oil pipeline connecting the two countries, efforts to enhance bilateral electricity grid connectivity, including a subsea cable, and collaborative endeavours in the field of renewable energy.

It was claimed that Sri Lanka would gain advantages from India’s efficient oil sourcing and processing methods, which can be paid in rupees, mitigating its balance of payments crisis. At the same time, the deal increases Sri Lanka’s dependence on India, as the country now purchases finished petroleum products instead of crude oil. To date, Sri Lanka purchased crude oil and refined it locally, which yielded massive economic benefits. The new agreement means that Sri Lanka will have to close its refinery, buy by-products like kerosene, and purchase refined diesel and petrol at much higher cost. The agreement to connect the two countries’ electricity grids via a subsea cable also potentially increases dependency as it allows India to sell electricity to Sri Lanka and to export the energy produced from Indian renewable projects in Sri Lanka.

In May 2023, Sri Lanka was forced to open its retail fuel market, which was previously dominated by the state-owned Ceylon Petroleum Cooperation (CPC) and the Indian Oil Cooperation (IOC), also a state-owned enterprise. This opened the door to China, as Sri Lanka approved a contract with the Chinese company Sinopec for a 20-year licence to operate 150 fuel stations and invest in 50 new fuel stations. The licence permits it to import fuel without relying either on Sri Lanka’s domestic banks or on India. In collaboration with Shell, Australia’s United Petroleum and the US company R.M. Parks have also been approved by the government to set up fuel stations in Sri Lanka. These agreements, which have been made in the context of the economic crisis, increase Sri Lanka’s external dependency and generally prolong its carbon lock-in.

The US and others enter the fray

While the US is a relative outsider in the Sri Lankan energy sector compared to India, China and Japan, in 2021, the United States Agency for International Development (USAID) introduced a Sri Lanka energy programme, which is both a strategy and a funding mechanism. It is ‘seeking to transform its power sector into a market-based, secure, reliable, and sustainable system by mobilizing investment to deploy advanced technologies, increase flexibility, and enhance competitiveness’.9 The aim is thus to make energy a market-based commodity.

In the same year, the US energy company New Fortress Energy (NFE) signed an agreement with the Government of Sri Lanka to build an LNG terminal off the coast of Colombo. It also enabled NFE to purchase the Sri Lankan Treasury’s 40% stake in a 310 MW power plant, which is a significant contributor to the national electricity grid. This agreement was signed without the knowledge of key political actors, including parliament. There was a massive local protest over the agreement but to no avail.

In the words of a trade union activist who joined the protest against the agreements:

The sheer audacity to sign an agreement regarding a matter of national importance at midnight without even informing the parliament underscores the nature of geopolitics and geopolitical actors’ power on local issues. The government gave in to the U.S. request while talking about patriotism locally. Sri Lankan energy sector is being dissected by influential external actors where it has become murky water.

In the wake of the economic crisis, Sri Lanka has also explored nuclear energy. By early 2023, India, the US and a few European countries had offered to build nuclear power plants in Sri Lanka. In June 2023, the country reached a deal with the Russian nuclear giant Rosatom to build a nuclear power plant that may run two reactors and generate 300 MW. Although Russia is a newcomer in Sri Lanka’s energy landscape, it is currently building Bangladesh’s first nuclear power plant – the Rooppur Nuclear Power Plant, in which India is also a stakeholder, is the first Indo-Russian nuclear project outside India. India’s role in the proposed Sri Lankan nuclear power plant is unknown.

Amid the geopolitical fray, Japan – a long-standing partner in the Sri Lankan energy sector through projects developed with bilateral financial and technical assistance as well as the Japan International Cooperation Agency (JICA) – has been sidelined. Nevertheless, Japan is continuing its 20-year partnership with Sri Lanka on energy policy but has increasingly joined with India in trilateral cooperation in this area.

Although there has been an expansion of renewable energy, this has not been at the expense of the continued development of, and investment in, fossil fuels. In January 2021, the Sri Lankan government approved two coal power plants and two LNG plants, each of which would have a capacity of 300MW, for a total of 1200MW. In September 2021, the President of Sri Lanka stated that the country would prioritise obtaining 70% of its electricity from renewable sources by 2030, yet the current version of Sri Lanka’s Long Term Generation Expansion Plan (LTGEP), which covers the 2020–2039 period, anticipates the addition of 55% more coal and oil capacity.

Sri Lanka’s energy crisis, triggered by the economic crisis, has renewed the ambitions of the coal lobby, promoting it as a cheap option and encouraging coal imports. External actors continue to be interested in new coal plants, presenting them as ‘eco-friendly’ and ‘clean coal’.

Sri Lanka has also explored LNG projects. In 2017, Sri Lanka and India signed a Memorandum of Understanding (MoU) in which an Indian company was to build a 500MW LNG plant. The MoU referred to a joint venture involving entities from Sri Lanka, India and Japan – but the project never took off, and Sri Lanka delayed the project despite Indian pressure. In August 2022, the government awarded a LNG contract to the Sino-Pakistan Engro Consortium following a competitive international bidding process. In August 2023, the Sri Lankan Sunday Times reported10 that the government had revoked the Engro project and planned to offer it to an Indian company, Petronet LNG Ltd. LNG is a highly competitive geopolitical space with many actors involved, aware of the untapped gas potential in the Mannar Basin on the western coast of Sri Lanka. In January 2023, the Minister of Power and Energy requested companies from Japan, India, and NFE to develop a joint proposal to supply, build and run an LNG terminal.

Table 1 gives an overview of the geopolitical entanglements in the Sri Lankan energy sector, especially in the last decade.

| Year | Country | Project | Amount | Status |

| 2000 | Japan | Sojitz Power Station | $104 million | 172 MW diesel-fired plant, privately owned. |

| 2006 | China | Norocholai coal power station | $1.35 Billion | 900MW plant was built through a loan from Export-Import Bank of China. |

| 2006 | India | Sampoor coal power station | $500 million | 500MW plant was to be built and operated by the National Thermal Power Corporation, India. The court ruling halted the construction on environmental grounds and after protests (see Box 1). |

| 2007 | US, Germany and others | Yugadanavi oil-fired power station | $300 million | 300MW plant was supported by export credit agencies in the United States, Germany, Netherlands, Poland, France, and Austria. |

| 2010 | USA | India–Sri Lanka cross border grid connection | N/A | USAID funded the pre-feasibility study. |

| 2016 | India | Joint Working Group on ‘Cooperation on Power Sector Between India and Sri Lanka’ | India initiated a joint working group to work on India–Sri Lanka energy cooperation. | |

| 2017 | India and Japan | Building LNG plant | A tripartite agreement between India, Japan, and Sri Lanka was signed to bring LNG to the energy mix. | |

| 2018 | China | LNG plant inside Hambantota harbour | $500 million | China was awarded the first LNG plant to be built inside the Chinese-controlled port. |

| 2021 | USA | Yugadanavi LNG plant | N/A | 300MW LNG agreement was signed between the government and US-based New Fortress Energy, which acquires 40% of Yugadanavi oil-fired power station. Following strong public protest it has not yet been implemented. |

| 2021 | China | Hybrid renewable park in the Islands in the Northern province | $12 million | The Sri Lankan government cancelled the tender given to Chinese companies due to protest from India. |

| 2022 | India | Hybrid renewable park in the Islands in the Northern province | $11 million | Grant from India on condition that the tender be given to the Indian company. |

| 2022 | India | Sampoor solar park | $115 million | Indian National Thermal Power Corporation was permitted to build a 135 MW solar park in the land previously allocated for the coal plant. |

| 2022 | India | Trincomalee oil tanks development | N/A | India will jointly develop the oil tanks storage facility and have access to the strategic port in Trincomalee. |

| 2022 | India | Wind power project in Mannar and Pooneryn | $750 million | Indian company Adani Group was awarded the tender as requested by the Indian government. |

| 2022 | China and Pakistan | Supply LNG and a pipeline network | N/A | China-Pakistan Engro Consortium won the tender to provide LNG to Sri Lanka. India protested strongly and in August 2023 it was cancelled. |

| 2023 | India | Supply of LNG and a pipeline network | The tender was awarded to Petronet LNG Ltd of India. | |

| 2023 | India and Oman | Oil refinery in Hambantota International Port | $3.85 Billion | India and Oman were awarded the tender in 2019, but the project stalled. The government cancelled the project in 2023. |

| 2023 | China | Oil refinery in Hambantota International Port | $4.5 Billion | Sinopac, a Chinese company, was awarded to build an oil refinery in Hambantota International Port on a 99-year lease. |

| 2023 | China, US and Australia | Lease of fuel stations | Approval was granted for three oil companies from China, the US, and Australia to lease 150 fuel stations for each company to operate in the local market. Indian Oil Corporation already owns and operates 211 fuel stations in Sri Lanka. | |

| 2023 | India | India–Sri Lanka cross-border grid connection | Sri Lanka and India agree to build cross-border grid interconnection. |

Against this backdrop, it is essential to assess the impacts of external involvement and funding on Sri Lanka’s energy transition ambitions. Sri Lanka has set a 2030 target to achieve 70% renewable energy in electricity generation. Given the prevailing economic conditions, however, Sri Lanka will be unable to meet its climate commitments. Four reasons have especially halted the transition to renewables. First, due to the crisis, local renewable projects have not taken off. Second, the crisis has deepened the reliance on fossil fuels and new energy infrastructure is also inclined in that direction. Third, Indian renewable projects go alongside cross-border transmission, which means that the renewable energy generated by Indian companies in Sri Lanka may be primarily for Indian consumption. Fourth, Sri Lanka has gradually lost its energy sovereignty by privatising and allowing the market forces to decide energy prices. All of this has undermined the core principle of ‘affordable energy for all’.

Illustration by Matt Rota©

Takeaways from Sri Lanka’s experience

The energy transition process in Sri Lanka has been characterised by a relatively subdued and ineffectual approach that calls for more decisive actions. Its transition to renewables has been bogged down by the pandemic and the economic crisis, when the focus shifted back to ensuring energy sufficiency rather than energy transition. The unfavourable economic conditions undermined the possibility of renewable energy uptake and facilitated the continuation of carbon lock-ins.

As Figure 1 shows, Sri Lanka’s transition to renewables has been slow, which can also be attributed to weak institutions and a failure to integrate policies and frameworks into a more comprehensive national policy, thus allowing the overreliance on external actors and geopolitical powerplay. The economic crisis has deepened the power of these geostrategic interests and permitted geopolitical actors to dictate the country’s energy future.

The transformation of Sri Lanka’s political economy following liberalisation has led to a shift away from state control over private capital, resulting in weakened state institutions and limited public finance. As a result, the dynamics of the relationship between the state and the private sector in Sri Lanka have been reconfigured, facilitating the resurgence of geopolitical influence in the country’s energy sector.

These factors have resulted in a state characterised by a failing energy transition, in which the process of decarbonisation becomes increasingly dissociated from considerations of energy security, hindering progress towards social justice and limiting its scope. Coal, for example, continues to be supported even though it is the most polluting form of fuel. Despite the urgent need to move towards a post-carbon world in view of the climate crisis, in Sri Lanka, geopolitical interests predominate over the climate and the environment.

The fierce competition for energy infrastructure projects in Sri Lanka proves that the geopolitics of energy is playing an increasingly important role in shaping energy politics, provisions and transitions in similar countries. The influence of traditional powers (former donors, i.e. OECD countries) is waning, and new(er) powers are rising to take their place. It had been anticipated that the development of renewable energy sources would reduce the geopolitics of energy, create affordable and available renewable energy for countries across the global South, and ultimately assist these nations in meeting their climate goals. However, in Sri Lanka this has not proven to be the case.

A prevalent criticism of North–South cooperation is that it leads to neo-colonialism because it is not based on equitable partnerships. This is primarily because countries in the global North prioritise the extraction of resources from the global South, rather than focusing on adding socioeconomic value to these resource-rich countries. Sri Lanka’s situation shows that this dynamic also applies to South–South cooperation. The current situation is characterised by the rise of a Chinese form of neo-colonialism, as well as a neo-colonialism driven by Indian aspirations for regional hegemony. The Chinese investment approach, anchored on the policy of ‘non-interference in the local affairs,’ has become attractive to many global South countries, whereas the US investment approach has always been known as ‘strings attached’.

China and India are positioning themselves as global South leaders capable of providing knowledge, finance, and technology to assist other countries in their energy transitions. This has its basis in a historical background of cultural interchange and the concepts of South–South and post-colonial unity, as well as the arguments that China and India are addressing infrastructural deficiencies in countries such as Sri Lanka. However, as these two Asian countries expand their economic and political influence, it is important to note that they too are seeking raw materials, markets, and geopolitical advantages outside their own territories.

The Sri Lankan case also illustrates that external actors have built their own energy infrastructure there. India and China have been licensed to build oil refineries, and several external actors now own and operate fuel stations. India has won tenders to build and operate renewable plants, including plans to export electricity to India. This is a new form hegemony. It’s not just about trading commodities, owning industries or controlling markets but also physical infrastructure that is much more permanent and consequential in terms of national sovereignty.

A final takeaway is that energy infrastructure has considerable power and influence in the political and national economy, providing the space both to facilitate the hegemonic ambitions of the geopolitical actors and to exert considerable control, thereby acting as a counterweight to competing actors. Sri Lanka’s economic revival is further undermined by the actions of external actors in the short and long term. When owned locally, energy infrastructures have a massive financial advantage in the long run, as proved by Sri Lanka’s hydropower plants. The emerging externally controlled energy infrastructures will gradually erode energy independence and take control of the local energy architecture. The economic crisis has jeopardised the citizens’ wishes, and there habe been no public consultations on the upcoming energy infrastructures and policies. This is a question of justice and equity.

Concluding thoughts

The Sri Lankan case goes beyond the conventional understanding of energy geopolitics, where energy is seen as a tool for engagement and trade, as it has allowed geopolitical actors to gain geostrategic territorial control and influence over the whole island. Sri Lanka is committed and needs to make the transition towards greener energy, but the country is also a competitive field for geopolitical powers that push for different kinds of energy projects and/or infrastructure, and to gain territorial control in geostrategic Sri Lanka. These geopolitical actors are not only pushing for non-renewable energy, but the clashes between regional titans also hamper Sri Lanka’s energy transition. The economic crisis is a critical juncture in the energy (geo)politics that shows Sri Lanka’s vulnerability and limited leverage against the larger powers, as most vividly demonstrated by India’s inroads since the economic crisis.