Who profits from the green energy rush? Derisking and power relations in Africa’s renewable energy finance

Derisking is touted as the panacea for delivering finance for expanding renewable energy in the global South, but the experience of renewable energy projects in Senegal and Namibia shows that foreign investors are being furnished with excessive protections from risk with all the financial, social, regulatory and long-term costs imposed on states and marginalised communities.

Illustration by Matt Rota©

Global financial markets and structural power in renewable energy in the African continent

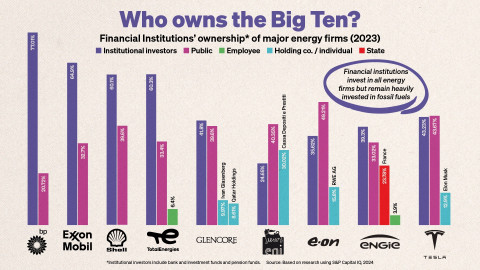

The volume of capital seeking profitable investments in financial markets has increased enormously since the 1980s.4 The pressure on profitability in the productive sector in the industrialised countries, redistribution in favour of wealth-owning social groups and the turn to pension systems based on capital markets have contributed to this development. The growing latitude for financial actors and the creation of new financial practices further fuelled the increase of financial capital.

|

Box 1. Power in global finance Global finance is structured by power relations. They affect, for example, the structures and regulation of financial markets or the unequal distribution of financial benefits and harms. This is clear in terms of access to financing sources, the distribution of profits and vulnerability to crises. Since financial globalisation emerged from colonialism and post-/colonial structured capitalism, African economies still occupy a subordinate position in global financial relations. Among other things, this affects the depreciation of exchange rates and how financial instability forces countries to react to the dynamics of international financial markets. The debt crises of the 1980s forced many countries to accept loans from the International Monetary Fund (IMF) and related structural adjustment programmes. These not only prioritised the repayment of private-sector loans but also placed conditions on countries to push through economic liberlaisation, opening up financial markets for global capital. As a result, countries are exposed to volatile financial relations, sometimes called the 'liquidity tsunami'. |

Since the 1990s, there have been investment opportunities in new areas such as housing or information technologies as well as in new parts of the world. Many countries have subsequently experienced repeated liquidity tsunamis:5 a temporary influx of investment, a change in shareholders’ profitability expectations, and a more or less sudden withdrawal of capital.6 Hopping in and flying out when expectations change, short-term finance in particular increases the risk of recurring financial crises. This dynamic is illustrated by the so-called Asian crisis in the late 1990s or the dotcom bubble in the early 2000s. After the 2008 global financial crisis, the volume of excess liquidity in search of profits has increased, as low interest rates further fuelled the force of the liquidity tsunami.

Today, the so-called green economy, above all the renewable energy sector in economies in the global South, is one of the promising destinations for global financial capital to invest. While there is a need for massive investment in infrastructure, the technological paths and economic gains remain unclear and private finance perceives severe investment risks. Unsurprisingly, therefore private finance seeks to pass these possible risks on to host governments, in the form of public financial support. While finance for public infrastructure has always entailed a blend of private and public funding, de-risking aims to reorganise energy economies, encompassing a specific set of instruments along with an accompanying narrative.

Until the early 2000s, ‘derisking finance’ was used eclectically, referring to business outsourcing, microfinance or pension fund portfolios. In the wake of the financial crisis, de-risking became more nuanced, focusing on macroeconomic restructuring, liquidity risks and financial stability. When the macroeconomic discourse began to embrace the idea of a ‘green recovery’, this led to a more specific debate, centred on green finance and promising, but still risky, markets in the global South. The E3G think tank’s proposal at the London G20 summit7 was soon followed by in-depth conceptual research by Deutsche Bank and by the United Nations Development Programme (UNDP).8 This work suggested a detailed de-risking methodology for market-creating policies to create a promising environment for green investment.

Essentially, the rationale of de-risking is the following: Although costs of renewable energy have fallen dramatically, perceived risks prevent investors in countries across the global South from financing the infrastructure for renewable energy. To mobilise the necessary funds, there is a need for risk-mitigation instruments to make an economy attractive for investment, such as by guaranteeing a stable flow of returns.

These instruments provide a safety net for private investors based on a bundle of measures such as risk assessments, export credit insurance, investment guarantees, premium payments, the multilateral development banks (MDBs) as lenders of last resort, technical assistance and political consultancy as well as domestic regulatory initiatives to provide a secure and predictable policy context. De-risking was quickly adopted as a key strategy to address the challenge of financing sustainable infrastructure. A few years after this first UNDP policy initiative, these ideas entered the GET-FiT Program, which funds renewable energy-projects in Uganda and Zambia and also inform the World Bank’s multi-country programme Scaling Solar and Italy’s RES4Africa programme, to name just a few.

De-risking is now ubiquitous in climate finance, featuring in many policy recommendations from the World Bank, IMF or the United Nations – respectively ‘From Billions to Trillions’, ‘Building Back better’ and ‘Maximizing Finance for Development’. Large-scale infrastructure and renewable energy projects in line with the Sustainable Development Goals (SDGs) and Agenda 2030 have become investable assets as a means to attract profit-seeking international capital.

The macroeconomist Daniela Gabor referred to this as the ‘Wall-Street Consensus’, which means that, in contrast to the earlier Washington Consensus, the mobilisation of private financial capital has now become a political and developmental priority. Ultimately, this is a radically market-based approach to development finance centred on the interests of finance capital. As Gabor suggests, this culminates in a ‘de-risking state’,9 whose most significant functions are no longer welfare and human or territorial security, but the production of attractive investment opportunities, moderated by investor-friendly institutions, whose structure resembles governmental or transnational chimeras. In the energy sector, this may include energy auctions facilitated by private consultancies and law firms that are aimed at western investors, as the case of Zambia clearly shows.10

In what follows, we focus on projects showing different levels of de-risking: the JETP case highlights de-risking at an abstract, inter-state level, the Senegal case underlines the daily realities and Namibia illustrates how it can transform an entire economy.

The de-risking strategy of the Just Energy Transition Partnerships (JETPs)

In the context of renewables in African countries, Just Energy Transition Partnerships (JETPs) have been hailed as innovative climate finance mechanisms. Yet they also illustrate how power relations and structural inequalities are reproduced through renewable energy finance. Negotiated between the G7 and global South countries, JETPs aim to catalyse a shift from fossil fuels to renewable energy.

The first JETP, announced at COP26 in 2021 between the G7 and South Africa, involves an initial US$8.5 billion investment to make the transition from coal to renewable energy. It funds projects for grid improvement, power generation, electric vehicles, and green hydrogen and proposes a just transition with a focus on job creation and skills training. A JETP with Senegal, an aspiring gas producer, signed in June 2023, allocates US$2.7 billion for 40% renewable energy by 2030.

While the fact that governments in the wealthy countries are now beginning to acknowledge their climate responsibilities and step up their efforts to provide climate finance, the JETP financing model raises many concerns. First, while many countries across the global South have demanded climate finance, the way JETPs are set up serves the geopolitical interests of the G7 states that aim to strengthen their global political and economic influence, including to respond to the Chinese Belt and Road Initiative.

More concretely, only a tiny fraction of the funding comes in the form of grants – 3-4% in South Africa and 6% in Senegal. The rest is in the form of hard-currency loans – which, despite the below-market interest rates, must be repaid. This exposes recipient countries to debt risks when local currencies weaken and debt repayments become more costly, such as in South Africa where since 2000 the Rand has lost 200% of value against the US dollar.

In addition, the JETP financing model also relies on a de-risking strategy. Public money is used to fund private corporations through public–private partnerships (PPPs). In the electricity sector, which accounts for most JETP funding in South Africa and Senegal, this means investing in grid infrastructure to create the conditions for private energy corporations, so-called independent power producers (IPPs), to set up new projects.

Specifically, de-risking IPPs entails government subsidies and guarantees for the offtake of the energy produced through agreements to purchase power from the IPPs for a fixed price and a fixed period of time. This secures long-term revenue for the private sector, while exposing host countries like South Africa and Senegal to commercial risks and exacerbating their foreign debt as they provide sovereign guarantees for private finance.

The focus on attracting private finance also means that insufficient funds are allocated for Just Transition measures that are not considered ‘bankable’, as they do not directly have a return on investment – for instance, a socially sensitive tariff system, gender-sensitive skills training and employment programmes, or technology transfer. JETPs do not support local renewable energy manufacturing, which is where most high-quality jobs and economic value creation are found, and so do not contribute to sovereign green industrial development and long-term employment and community benefits – only 0.6% of the pledged contributions to South Africa’s JETP goes to skills development, economic diversification and social inclusion.

Furthermore, because private energy producers not only need to recover their operating costs but also seek to make a profit, this may lead to higher energy tariffs that incorporate profit margins and interest payments, exacerbating energy poverty. Finally, civil society and communities have been left out of the JETP negotiations. The deals are negotiated behind closed doors between the G7 negotiating as a bloc with individual countries, which have repeatedly expressed concerns over the terms and conditions of these deals, which often remain undisclosed to the public. Social movements and trade unions have come up with alternative proposals for just climate finance11 that focus on debt cancellation,12 climate reparations and public investments rather than de-risking private finance.

This financing landscape seems far removed from people’s daily lives. But global finance in the form of loans, equity shares or any other instrument finds its way into concrete renewable energy projects, such as the Hyphen project or the Taiba N’Diaye windfarm in Senegal, that have significant impacts on people’s lives.

Investment adventures in Senegal – the Taiba N’Diaye windfarm

Chris Antonopoulos, the CEO of Lekela, boasts that you need the ‘the spirit of an adventurer’13 to build windfarms in Africa. Lekela is a London-based renewable power company, which has constructed the 160MW Taiba N’Diaye windfarm in Senegal. What is an investment adventure for some has the potential to destroy the basis of subsistence for others.

This windfarm is an exemplary case for how renewable energy production is turned into an asset, providing opportunities for profit-seeking investors that are predominantly based in the global North. This is enabled through an institutional environment of de-risking both by the Senegalese government as well as international development finance institutions, creating the safe and stable environment for European investors. The windfarm is viewed as an investable asset from which distant investors expect a rich return, but at the same time it is the home and site of contestation for the affected communities.

Senegal’s energy policy has been oriented towards creating a ‘de-risking environment’, enabling private energy production. In a recent reform of the power sector, the government shifted towards embracing private finance by removing regulatory barriers and creating a conducive environment for international investors. The core of the reform is the unbundling of Senelec, the national electricity company and off-taker – the purchaser of electricity in renewable energy projects, and the strengthening of private actors in energy production.14 IPPs tender for production rights, while the regulator’s long-term energy planning offers investors a stable basis for long-term investment decisions. The liberalisation of the electricity market opens the market for private energy production and domestic planning aims to make it attractive for foreign capital.

Following this policy direction, since the early 2010s the share of energy production from IPPs has risen to half of Senegal’s overall installed capacity, mainly through foreign direct investment (FDI). About half of the country’s solar capacity is owned by French companies.15 The colonial power is back – or perhaps never left.

The Taïba N’Diaye windfarm fits well within Senegal’s energy policy agenda. The French company Sarreol developed the project and later sold it to Lekela, which then developed it towards financial profitability with a loan from the Development Finance Corporation (DFC), the US government development finance institution, and an investment guarantee from the Multilateral Investment Guarantee Agency (MIGA), a branch of the World Bank. Lekela was owned by two European-based infrastructure equity funds with opaque ownership structures when the construction began and has since been sold on to other investors. Today, the windfarm consists of 46 wind turbines, a number which is soon expected to double, and currently affects more than ten villages with an estimated population of 25,000.

Private investors’ need for a high degree of security leads to a financing constellation and business models that merit closer examination. Lekela sells the produced electricity to the national energy company Senelec and uses the revenue to service the creditors’ loans and pay its shareholders the anticipated returns. Lekela is thus obliged to operate on a for-profit basis.

In order not to risk this cash flow, the business model is secured by fiscal de-risking. The Senegalese government provides a bundle of guarantees for electricity off-taking and the World Bank does the same for political risks, thus securing the investors against almost all kinds of jeopardy.

In a so-called Power Purchase Agreement (PPA), Senelec is contractually obliged to pay for all the energy produced – even if there is no demand for it, or the grid is overloaded. This guarantees Lekela’s revenue. Over and above this, Senegal also provides a sovereign guarantee to cover the possibility of Senelec defaulting on payments.

Investors may also choose to draw on so-called political risk guarantees provided by the World Bank, such as a political risk insurance (PRI) or a partial risk guarantee (PRG). These guarantees can be triggered in cases such as non-payment by Senelec and the state, expropriation, or war and civil unrest. Thus, apart from project- or technology-based risks, investors are hedged against virtually every form of insecurity.

The profit-driven logic behind the project financing and the need for constant revenues to serve the creditors shapes inequities at the lower end of the windfarm, namely in how it affects local communities. These inequities are even more striking in the contrast between Lekela’s own investment tales and grassroots dissent.

Investors like to narrate the story of developmental benefits of large-scale infrastructure projects like job creation. According to Lekela, a total of just 380 people have been employed during construction, all from the surrounding villages. However, villagers clearly express their frustration about this recruitment as the contracts are temporary and mainly in low-skilled.

This is even more problematic because people’s land has been expropriated for the windfarm, depriving them of their means of subsistence. About 420 farmers who have been affected by the windfarm have been compensated. Fair enough, the compensation has been above the usual national rate. While this could be seen as a noble gesture on the part of Lekela, the question of land represents the fundamental divide between the investors and the affected community. Leleka’s investment story proclaims a modernising – but imaginary – ‘from farmland to wind farm’, assuming progress and development, but conversations with farmers give a very different sense of the meaning of farmland – which means life, the basis for food and income. The compensation might alleviate their lives in the short term, but it cannot make up for the loss of their land. The issue of land brings colonialism from the past to the present. The prevailing idea of terra nullius justified the illegitimate Scramble for Africa during colonialism, organising land grabs for the colonial plantation economy in ways that we can still see in today’s patterns of extractivism.16

From the perspective of the investors, the windfarm is entirely a success story of modernity and development. It is assumed to have improved villagers’ lives such as by constructing a market place, an IT centre in the school or solar panels for local farmers. The official investment story is illustrated with women dancing to express their joy about the investments. It draws on almost every cliché in the book – exactly how Binyavanga Wainaina taught us how not to write about Africa.17

The story appears as pure philanthropy leading to progress in the surrounding villages while the investors occupy the moral high ground. As the investors proclaim, the project is ‘more than a windfarm’. What the story of Lekela hides is that the windfarm will generate stable, long-term revenues to the European developer, made possible through the de-risking instruments described above. This however shifts risks to the affected communities and onto the state’s balance sheets – and thus adds a further burden for the state budget and provides short-term profits for the private company.

Looking at the windfarm from a macro perspective shows how investments in renewables, even in a single windfarm in Senegal, are increasingly entangled in the circuits of global finance. Lekela has recently been sold to the operator Infinity, which owns many IPPs across Africa – it stretches belief that this sale took place without a rich return for the company’s previous owners. What this on-selling entails is a disconnect between the owners of the project and the community. At the very least, Lekela has been working with the local communities for several years. The new owner does not have this relationship, which risks undermining any responsibility and accountability for the impacts of the windfarm on local communities.18 Lastly, what is problematic at the macro-political level is the possible influence that the de-risking instruments grant to multilateral organisations. The threat to trigger a risk guarantee is a disciplinary measure, insofar as if the government does not pay, it must meet the guaranteed sum as the World Bank has the power to impose structural reforms in the energy sector, thus undermining state sovereignty.

The story of Lekela both conceals and downplays all these structural hierarchies. Its narrative includes only two roles: the benevolent European investor and the grateful recipients. Despite – or exactly because of – this narrative, let us not forget that the Taïba N’Diaye windfarm is an investment that affords powerful and wealthy investors a profit from selling electricity that the Senegalese population pays with their electricity tariffs.

It is therefore important to highlight that those who are affected by the windfarm formed a collective to defend the rights of the commune of Taïba N’Diaye (Taxawu Askan Wi), to confront the project developer, demand their fair share of the income and a right to a say in decisions affecting them. Given the financial superiority of Lekela and its power to define the investment narrative, it is crucial to see what happens at the margins, how people are struggling every day to counter financial power inequalities, and what these struggles tell us about the global financial structure.

Green Hydrogen Dreams in Namibia

From the northwest of Africa to the very south, the rush into renewables takes yet another form. While the Taïba N’Diaye windfarm was built to supply the national energy grid, Namibia’s whole emerging hydrogen economy is oriented towards serving European economies. Since 2021, Namibia has rapidly opened its doors to any number of investors, corporates and technical assistance as well as incorporating de-risking institutions to accommodate its goal to become ‘a green hydrogen superpower’.18

Fiscal de-risking

In order to do this, the Namibian state has constructed a blended finance architecture that draws heavily on an international public–private de-risking ecosystem to set in motion the nascent hydrogen economy.19 This includes a blended financing platform called SDG Namibia ONE for the de-risking scale-up of the green hydrogen strategy and respective private-sector initiatives. SDG Namibia ONE’s concessional capital is meant to drive down the overall cost of capital and thus provide fiscal protection to what the country hopes will be an influx of private investors, ready to deploy capital and meet investment needs. Launched at COP27 in Egypt, the platform is now managed under the Namibian Environmental Investment Fund by two Dutch organisations, Climate Fund Managers and Invest International Dutch.

The platform has received grants for technical assistance from Investment International (€40 million) and the European Investment Bank (EIB) (€5 million) in order to streamline the platform with investors’ needs and a further a €500 million concessional loan from the EIB. The government is using this money to finance its equity stakes in the prestigious large-scale hydrogen project under the management of Hyphen Hydrogen Energy.

While such approaches are still highly recommended by the World Bank Group20 and the OECD,21 it risks leaving countries more vulnerable to debt crises, and ultimately expands the power and influence of financial lenders. With a state-owned debt of 60%, the addition of loans adds to Namibia’s overall foreign debt and puts further pressure on the national budget – should any of the projects fail, it is the Namibian state and its citizens that will be left with the burden of debt repayment.

Moreover, both the creditors and project developers are part and parcel of a European network that aims to capitalise on and use green hydrogen and its derivatives for their own purposes. A local bank representative, who was involved in drafting the regulations of the Hyphen investment, put it in a nutshell: ‘In reality, it’s really money spent to pay salaries of Europeans […]. You’ll have these big contracts multiyear offtake agreements but between European institutions’.

De-risking ecosystem

The rush for the new ‘green oil’ and the creation of such an enabling environment has put many governments and investors on notice. Namibia has signed memoranda of understanding (MoUs) with Germany, the Netherlands and the EU for the export of green hydrogen. Other investors such as Anglo American, the Port of Rotterdam, Belgium, and several Japanese companies are currently implementing their own hydrogen-related projects.

The most prominent project is located in the Southern Corridor Development Initiative’s Tsau ǁKhaeb National Park and run by Hyphen – a consortium between the German energy company ENERTRAG and investment firm Nicholas Holding. The secretive investment firm is registered in the well-known tax haven, the British Virgin Islands, although the operational arm is managed by its subsidiary Principle Capital, which has previously been involved in a controversial Mozambican biofuels project.22

The projected investment comprises US$9.4 billion, which is equivalent to Namibia’s gross domestic product (GDP) in 2020. The plan is to build solar panels and electrolysers to produce green hydrogen in a protected area of 4,000 km², mostly if not exclusively for export to Europe. The Namibian government envisages 10 to 15 more of these projects in the national park.

In order to address political and regulatory risks that may impede foreign capital investment in its nascent industry, such as ‘complicated’ access of foreign corporates to land, strong environmental safeguards or visa requirements, the German government, among others, has granted the Namibian government a technical assistance programme. Assistance is provided by multinational law firms that will develop policy and legal regulations. The ultimate goal is to create an ‘enabling environment‘ in the interest of German and European investors. Selected firms for example for the hyphen projects are primarily of German and European origin.

Regulatory de-risking

Further proposed regulatory adjustments to accommodate the hydrogen economy are in the making. Currently, there are no dedicated laws for green hydrogen production intended for export, nor an appropriate safety regime to regulate the production, storage, transport and use of hydrogen and its derivatives (such as ammonia). To develop such regulations, Namibia is relying on costly foreign technical assistance from law firms and consultancies and the recommendations of organisations such as the World Bank and McKinsey.

Social movement Affirmative Repositioning (AR) leader Job Amapunda alleges that Hyphen is closely working with the Namibian government to create the legal framework for its hydrogen economy23 – indicating that a private project coordinator is effectively shaping the future regulatory framework for an entire emerging industry in Namibia adjusted to its preferences, requirements and needs.

While the Namibian government and European stakeholders celebrate the many agreements, strategies and partnerships that have been established within only a few months, civil society in Namibia has pointed out the danger of recurring financial dependencies, ecological degradation, and social exclusion amidst Namibia’s green hydrogen hype.

In terms of regulations, amendments to laws to the advantage of the project developers and in their quest to secure abundant production space for green hydrogen may facilitate land and water grabs. In the case of Hyphen and its current trajectory, the project will confront the largely unprepared town of Lüderitz with an enclave economy – an export oriented economy dominated by non-local capital – on its doorstep. While Hyphen announced the creation of 15,000 jobs and an additional 3,000 during the construction phase, similar to the case in Senegal, most of these will be temporary and for low-skilled labour.

Aside from precarious labour and living conditions on site, there are also the socio-ecological risks of conflicts over water and ecological destruction. These include the spill of brine from desalination plants into the sea or groundwater, the use of rare freshwater reserves as planned by the German government-funded Daures project, the use of national park sites for the Hyphen project, and the huge impact of the planned infrastructure, such as ports and plants on terrestrial and marine ecosystems. Financial markets are blind to such socio-ecological risks – as long as they do not endanger investments. The result is the socialisation of risks and the privatisation of profits especially for elites and international investors – which perpetuate the state’s indebtedness to international banks and constrain the space for intervention by civil society.

Civil society has expressed concerns about the lack of transparency and accountability regarding procurement processes, financial agreements and regulatory options. However, rather than engaging with civil society and addressing their legitimate concerns in a democratic and transparent manner, the Namibian government ‘warned locals not to interfere in the Hyphen Hydrogen Energy green hydrogen project’.24 German and European investors and politicians continue to paint the picture of green hydrogen partnerships among equals.

The history of German involvement in Namibia’s extractive past and present, including colonial occupation and the genocide of the Herero and Nama, are not part of the discussions. It is astonishing to see how quickly capital can be mobilised when wealthy countries’ interests are at stake, while there are still no reparations or even formal apologies for German colonial atrocities. When asked to describe the green hydrogen rush in Namibia, one activist responded: ‘We want this thing to be called what it really is. This is important. Even if people continue to bulldoze and get away with this thing, it must be called by its name: This is imperialism. This is colonialism’.

Illustration by Matt Rota©

The need for socially just and democratic models of financing

The picture these green energy cases presents is ambivalent. There is an urgent need for financing for renewable energy projects. The climate crisis puts the greatest pressure on some of the world’s most vulnerable countries and communities. Yet the current form of financing for renewable energy may add to those pressures rather than relieve them.

It certainly threatens efforts for global climate justice. Financing partnerships such as the JETP as well as specific renewable energy projects are often a gateway for global Northern interests and may well perpetuate green colonialism. Wealthy nations, domestic elites and multinational corporations all benefit, while the host countries and their citizens assume the financial and environmental risks as profits are privatised, and the state and consumers bear the transition costs.

Following in the footsteps of the 1970s’ call for a ‘new international economic order’, initiatives grounded in a global South perspective increasingly question the global climate finance architecture. The Bridgetown Initiative,25 a proposal for global financial reform spearheaded by the Prime Minister of Barbados, Mia Mottley, has created greater awareness of climate debt and a looming debt crisis, with 52 countries already in debt distress, or, in the case of Zambia, already facing bankruptcy. Mottley’s demand for IMF Special Drawing Rights (SDRs) struck a chord.

At the 2023 Paris Climate Finance Summit leaders convened to restructure the architecture of development finance in such a way that should redirect finance flows and guarantee a fair share of capital. Yet Bridgetown’s radical impetus was effectively a lost cause, as the Summit did not result in a debt-relief programme, but only in a piecemeal approach. Leaving aside the real impact of the Bridgetown Initiative, it represents an important contestation of the neo-colonial dynamics in climate finance and a call for just financial flows.

What is needed for justice in climate finance is a constant debate and practice between social movements, civil society, politics and the private sector. But unless this debate is firmly grounded in content and addresses inequalities of power, calling for justice risks being little more than so-called virtue signalling. This is illustrated in discussions of the JETPs. As trade unions and civil society have demanded, the negotiations on investment projects need to be inclusive and transparent, not based on secret deals signed behind closed doors between the donor and recipient countries. Only if this is guaranteed will civil society actors be able to demand more grants-based financing instead of conditional loans.

Demands for justice in renewables projects like IPPs raise further concerns. There is a need to establish financing models that transfer a fair and fixed sum of the returns gained by the private developers to the affected communities. People whose land is expropriated should be fairly compensated because this is often all they have. At the government level, local content rules should require international developers to create domestic economic value.

These demands are not abstract or utopian. They could easily be adopted provided there is the political will and space to do so. Yet the fact that such demands are so far from the reality on the ground shows the distance remaining. This calls for civil society and movements in solidarity with those who are directly affected by renewables to apply pressure on international finance investing in such projects.