Energy Transition Mythbusters: Myth #2 Free markets are the best route towards a low-carbon energy system

Topics

Traditional economic theories state that in a free market logic, supply and demand balances itself out in the most efficient way. Since the 1980s, this neoliberal approach has been thought to apply directly to the energy sector, promising an increase in efficiency and decreased costs. Proponents of this perspective have placed responsibility of achieving the transition mostly in the consumers, while conveniently ignoring that companies are the ones benefiting from this free market logic. In Europe, the growth in renewables has taken place despite liberalisation, rather than through it. Here is why.

Fourate Chahal El Rekaby

Key takeaways

-

Free markets are NOT the best route towards a low-carbon energy system.

-

Rather than increasing competition and choice, liberalised markets concentrate power in the hands of giant companies. In Europe, five firms maintain an oligopolistic grip over the energy system.

-

Liberalisation has seen energy poverty increase significantly: energy poverty doubled over a 10-year period across Europe during the period of energy liberalisation.

-

Liberalised markets often undermine energy sector investment. In India and the Philippines, energy investments stagnated in the aftermath of liberalisation. In contexts where competitive auctions have been used to facilitate energy transition, renewable prices have declined, leaving utilities struggling to survive and without the capacity to invest.

-

At the same time, free markets have allowed some energy companies to profit from increased price volatility: liberalising gas prices resulted in EU countries paying an estimated $30 billion more for natural gas in 2021 than they would have if they had maintained oil price indexation.

-

Carbon trading schemes have proved disastrous. While 18 years have passed since the 2005 launch of the EU ETS, 84% per cent of global emissions remain unpriced and the share of emissions priced high enough to be effective remains well below 1 per cent.

-

In reality, there has never been a free market in renewable power and nor is there ever likely to be: the renewables sector is propped up by public subsidies.

The myth

Conventional economic wisdom dictates that when buyers and sellers freely compete with each other, supply and demand balances itself out in the most efficient way possible. For pro-market politicians, commentators and think-tanks, this logic applies seamlessly to the energy sector.

From the 1980s onwards, liberalised markets have been established and enforced within energy sectors across the world, with the promise of increased efficiency and decreased costs. Proponents of this neoliberal paradigm vociferously oppose public ownership and planning. They argue that the ‘invisible hand’ of the market is a necessary corrective to the ‘bureaucracy’ and ‘coercion’ of the state, delivering instead competition, choice and the decentralisation of power.

In the face of climate change and the urgent need to decarbonise the energy system, pro-market advocates argue that as soon as more people start buying renewable instead of fossil-fuel-based electricity, energy companies will switch to renewable energy to meet this demand and the transition will speed ahead.

Free markets have concentrated power

Free-market myth advocates argue that once energy markets are liberalised and public energy companies privatised,5 new investors will enter the market, ushering in increased competition and choice.

The European energy system serves as a telling example of just how inaccurate this story really is. In 1998 and 2000, the EU passed directives which mandated liberalised markets for electricity and gas.6 Since then, a series of mergers and acquisitions has consolidated power into the hands of five enormous energy companies. Meanwhile, smaller producers and suppliers have been disadvantaged since the model of competitive auctions (described below) requires resources and expertise that smaller players lack.7

Free markets have worsened energy poverty

One third of the world’s population currently lack access to reliable power. In 2021, an estimated 860 million people across the global South have no access to electricity, with an additional 1.1 billion having only intermittent electricity access.8 An estimated 2.6 billion people in the South heat their homes using traditional stoves fuelled by charcoal, coal, crop waste, dung, kerosene, and wood.9 Indeed, as noted by the IEA: ‘For the first time in decades, the number of people without access to electricity is set to increase in 2022.’10

The issue is particularly pronounced in sub-Saharan Africa: 70 per cent of the world’s population without electricity access are to be found in this region; over half of the population lack electricity access according to 2017 figures.11 The situation appears to be worsening: according to the UN-partnered international energy access organisation Sustainable Energy for All, ‘Without more progressive policy and investment… many African countries will see an increase in their unelectrified populations by 2030.’12 Indeed, the IEA’s ‘Stated Policies Scenario’ estimates that without adequate measures, 660 million people will still lack access in 2030.13

Advocates of the free-market myth argue that the problem here is a lack of liberalisation. Since the 1990s, global institutions like the World Bank and International Monetary Fund (IMF) have been attempting to enforce free-market policies on countries across the global South, promising reduced energy poverty in the process. Yet this promise has yet to materialise. In the Philippines, for example, legislation was introduced in 2001 to deregulate generation, establish a wholesale market and open up the grid to private companies. The result was skyrocketing prices, which increased by 55 per cent between 2003 and 2010.

The situation in Europe is not all that different. Indeed, energy poverty doubled over a 10-year period across Europe during the period of energy liberalisation.14 Prior to the energy crisis, one in 10 Europeans were unable to warm their homes sufficiently in the winter, one in five were unable to cool their home sufficiently in summer and up to 100,000 died each year due to cold homes. The enormous price hikes beginning before Russia’s invasion of Ukraine are now worsening this situation considerably.15

It is notable that across Europe, departures from free-market logic have been necessary in order to bring energy prices under control amidst the energy crisis fuelled by the war in Ukraine. Pro-market governments have been forced to introduce price caps in order to ameliorate rapidly escalating energy poverty.16 A price cap can still mean transferring public money to energy companies. In the Netherlands, a price cap is costing taxpayers billions of euros to enable a subsidy to energy companies that keeps prices artificially low and profits high.17

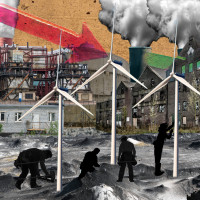

Image by Herbert Bieser on Pixabay

Free markets undermine renewables investment

In reality, there has never been a free market in renewable energy provision and nor is there ever likely to be. As discussed in Myth #1, governments have had to step in to facilitate energy transition through subsidies such as Feed-in-Tariffs (FiTs). Without these subsidies, renewable energy is simply not profitable enough for investors to act.

Investment in new generating capacity is profitable only when the unit cost of electricity on the wholesale market exceeds the costs invested in generating this electricity. Historically, the high costs of renewable generation have outstripped wholesale electricity prices, rendering renewables investments unprofitable. Now, as renewable generating costs come down, wholesale electricity prices fall, cancelling out the declining costs of investment and, once again, undermining opportunities for profit. As such, without public subsidies, investors simply steer clear of renewable energy.18 This dynamic is illustrated in the move away from Feed-in-Tariff subsidies towards competitive auctions discussed in Myth #1.19

Auctions have driven down renewable power prices as energy producers lowered their rates to compete for contracts.20 This has had a number of consequences. First, well resourced and large incumbent energy producers won contracts based on a very low energy price, outcompeting smaller community-based renewable energy producers that did not have the means to participate, let alone offer such unrealistic rates.21 In fact, prices were set so low that big producers sometimes were not able to follow through on project development because of insufficient returns.22

Second, because these auctions drove down energy prices and, in turn, profit margins, private investors lost interest. This resulted in a dramatic decline in private investment in new renewable energy projects.23 EU investments in renewables dropped precipitously when FiTs were replaced with auctions: across the EU, investment fell from $132 billion in 2011 to $59 billion in 2015. Annual solar capacity installations fell from 22 GW per year to just over 8 GW.24

Finally, falling electricity prices due to competitive auctions have been one of multiple factors contributing to a crisis for incumbent utility business models and what has been termed the ‘utility death spiral’. In 2018, the incomes of the three largest European utility companies (EDF, E.ON, and RWE) fell by 65 per cent, 22 per cent, and 85 per cent respectively.25 Alongside falling renewables prices, the issues here include declining market share due to the entrance of new actors within energy markets, alongside the escalating costs of integrating ‘variable’ renewable energy generation due to necessary grid upgrades and investments (see Myth #3).26

Since incumbent utilities are struggling, some governments have started issuing ‘capacity payments’ to fossil fuel producers for providing a backup supply of ‘baseload’ generation, in order to ensure security of supply.27 This is where we see the ‘liberalise and subsidise’ model in full swing. Governments are compensating for their lack of control over the energy sector by providing subsidies for all.

The utility death spiral we are witnessing mirrors similar dynamics that played out when liberalised markets were first introduced in the energy sector. One common consequence of early energy liberalisations was falling investment. State-owned utilities – where they were not privatised – lost market share and associated revenues, meaning that their capacity to invest in the sector was reduced. Simultaneously, the private investment in the sector that was promised often failed to materialise.

In the case of the Philippines mentioned above, for example, only 2.22 GW of generating capacity was added in the first 12 years of power sector reform, and this was mostly committed before the reforms took effect. A 2014 government report noted: ‘The government may need to involve itself once again in power generation to avoid power shortages in the future and keep hold of the current momentum being enjoyed as an investment attractive economy.’28

A similar experience has played out in India, where liberalisation reforms have seen private companies take on an increasingly bigger share of energy generation since the turn of the century. In India, the energy sector faces mounting debt. This is because poor people are unable to afford energy and are, therefore, forced to ‘steal’ energy through irregular power connections. In this context, the state has stepped in to guarantee the profits of private generator firms, with publicly owned transmission and distribution companies left to take on the debt.29 Consequently, India’s rural electrification programme has been substantially scaled back due to a lack of funds.30 And private investment in the sector has been sparse because of the risky market environment.

Experiences in India are indicative of a broader trend. Energy liberalisation reforms enforced by global institutions such as the World Bank and IMF have placed the imperative of ‘full cost recovery’ at their core. Full cost recovery subjects utility firms to market logics, obliging utilities to ensure that the full costs of service delivery are recouped from consumers. The issue with doing so is that, as with the India case, poor consumers often simply cannot afford to pay for electricity. Time after time, full cost recovery policies have stood in the way of electrification programmes designed to increase energy access.

In short, market logic such as full cost recovery prevent utilities from prioritising social or environmental goals over the financial bottom line. As a result, across the global South, the marketisation of utilities has come into tension with much-needed infrastructural investments that are pivotal to decarbonising the grid.31

Free markets make energy prices more volatile

The utility death spiral demonstrates the volatility of energy prices under a liberalised model. Indeed, higher and more volatile prices are endemic to the free-market paradigm.

Prior to liberalisation, gas prices were indexed to oil prices, meaning that they were set according to the average price for oil in the preceding months.32 However, producers are now free to profit from energy price swings. Gas companies can respond directly to external factors such as the war in Ukraine by raising their prices and cashing in on increased demand. Liberalising gas prices means that EU countries have paid an estimated $30 billion more for natural gas in 2021 than they would have if they had maintained oil price indexation.33

Finally, as a consequence of competitive auctions and falling production costs, prices for renewables can fall so low that producers actually stop manufacturing and selling new renewables installations because of their inability to cover production costs.34 For instance, global prices for new installations fell so steeply that China’s wind turbine suppliers declined from 63 in 2013 to 33 in 2019, largely from bankruptcies and mergers.35

Carbon trading has failed

Carbon trading schemes see governments capping total emissions at a certain level and then allocating firms emissions quotas in line with the total cap. Firms that emit less than their quota can sell their excess ‘carbon credits’ via open markets to firms wishing to emit more than their quota permits. Thus, in theory, markets help allocate emissions within the constraints dictated by governments.

Pro-market proponents have long argued that once carbon is properly priced, markets will deliver rapid decarbonisation. Yet the EU’s flagship Emissions Trading System (ETS) has been besieged by problems including weak pricing and windfall profits. This is little surprise, given that permits were allocated according to benchmarks designed by the companies they were supposed to be regulating.

18 years have passed since the 2005 launch of the EU ETS, yet 84 per cent of global emissions remain unpriced and the share of emissions priced high enough to be effective remains well below 1 per cent.

We need to reclaim energy from the market

The free-market approach to the energy sector has ushered in new formations of monopoly power, worsening energy poverty, rendering prices increasingly volatile and causing stagnating investment. Energy is a basic need and should be delivered as a public good rather than a commodity. Treating energy as such means reclaiming it from the market and removing market logics from public utilities, allowing these companies to prioritise social and environmental values over profitability.