Financialisation: A Primer

A beginner’s guide to financialisation: how it works, how it shapes our lives, the forces that lie behind it, and how we can resist.

Descargar PDF

Autores

Introduction to Financialisation

1. What is financialisation and why is it important?

2. When did financialisation begin?

3. How has the financial sector changed?

4. What are some of the key processes and practices that characterise contemporary financialisation?

5. Who are the main actors?

Impacts of financialisation on the economy

6. What was the promise of ‘liberalising’ capital flows and what has been the reality?

7. How has financialisation changed the economic structure?

8. How are non-financial firms, such as supermarkets, changing in the context of financialisation?

9. How are public services affected by financialisation?

10. What is shareholder value and what is its role in financialisation?

Social impacts of financialisation

11. How does financialisation affect the household?

12. How does financialisation affect employment and income inequality?

13. How did securitisation of mortgages lead to the US financial crisis?

Impacts on food, agriculture and nature

14. How has financialisation shaped food, agriculture and other commodity markets?

15. What role did speculative trading play in the world food price crisis in 2007–2008?

16. What is the financialisation of nature?

Exploring the forces behind financialisation

17. How did financialisation become so dominant?

18. What regulations were put in place to control financialisation after the global financial crisis?

19. Why did the financial crisis lead to the financial sector becoming more powerful?

Resisting financialisation

20. What is ‘financial democracy’ and why is it problematic?

21. How can financialisation be resisted?

Jargon Buster

Recommended Reading

Notes

Is there a question you would like answered or do you have comments to improve this? Please email tni@tni.org and we will try and include your feedback in updates to any future editions of this primer.

This primer is updated for the 10 Years On From The Crisis European Action Day (15th September 2018). TNI supports the 10 Years On campaign, which is an initiative of the Change Finance coalition.

Introduction to Financialisation

1. What is financialisation and why is it important?

Financialisation is a relatively new term, which covers such a range of phenomena that it is difficult to define precisely. The most-cited definition, from Gerald Epstein, states: “financialization means the increasing role of financial motives, financial markets, financial actors and financial institutions in the operation of the domestic and international economies”1.

It is a process in which financial intermediaries and technologies have gained unprecedented influence over our daily lives.

The expansion of financial markets is not only about the volume of financial trading, but also the increasing diversity of transactions and market players and their intersection with all parts of economy and society. In short, financialisation must be understood as a radical transformation within the financial sector that has altered entire economies – from the household and the firm to the functioning of monetary systems and commodity markets.

Research has shown that financialisation has increased inequality, slowed down investment in ‘real’ production, mounted pressures on indebted households and individuals, and led to a decline in democratic accountability.

2. When did financialisation begin?

While the beginnings of financialisation can be traced back to the 1950s, it was the fall of the Bretton Woods monetary system in the early 1970s that accelerated growth in global liquidity and prompted a surge of financial liberalisation and deregulation.

The Bretton Woods agreement anchored international currencies to the US dollar, and the fixed the US dollar to gold. This provided predictability in exchange rates and stopped gains being made from speculation. The agreements had been established to guard against the rise of ‘protectionism’ that had marred the interwar years. This benefited the US as the world’s biggest exporter and its ‘reserve currency’. Consequently, the US went on a spending spree to fund the Cold War, in particular the Vietnam and Korean wars, as well as to fund the Marshall Plan in Europe to help the post-war economies to buy US goods. The US was printing ever more dollars and spending them overseas, which meant that the volume of dollars in circulation greatly surpassed the US’s gold reserves, making the dollar–gold link look ever more unsustainable. As concern mounted that excessive US public debt was threatening the fixed convertibility of dollars to gold, in 1971, US President Richard Nixon decided unilaterally to end dollar–gold convertibility, formally bringing the Bretton Woods agreements to an end. What followed was a decade of deregulation of currency movements as the world moved to a new regime of free trade in goods, floating exchange rates and free movement of capital.

Floating exchange rates and unregulated capital flows presented hazards for many, but also provided opportunities for financial innovation (such as derivatives) to deal with these risks and for speculation to profit from them.

The US, freed from any commitment to maintain dollar–gold convertibility, could now pay its debts with its own currency without significant constrictions in supply. The US deficit (the amount a country spends compared to how much it earns) increased rapidly and with it the number of dollars or dollar-denominated financial assets in circulation, most of which ended up in the reserves of other countries’ central banks. Increased reserves allowed these banks to expand credit in their own economies and worldly liquidity surged

This opened up new profit-making possibilities in private financial markets, and those seeking to capitalise pushed for the dismantling of barriers to capital mobility and other regulations that limited their activities.

3. How has the financial sector changed?

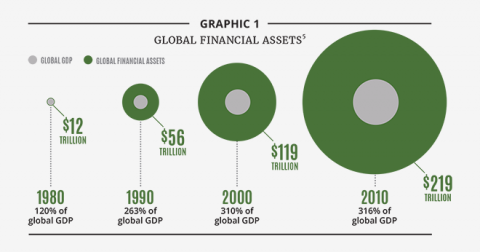

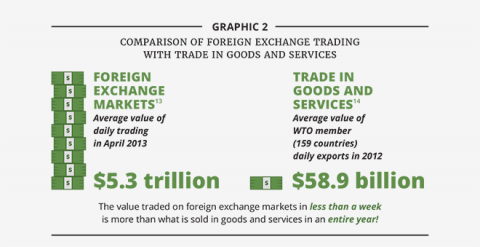

Since the 1970s, the value of global financial assets has soared. Not only have financial markets grown in absolute terms, they have also expanded in relative terms: the value of global financial transactions rapidly surpassed that of ‘real’ production business and commerce (see graphic 1). For example, in 1973, the ratio of the value of foreign exchanges in transactions to global trade was 2:1; in 2004 this ratio reached 90:1.2 By 2017 the total value of global trade was $17.88 trillion a year. That compares with foreign exchange transactions of $5.1 trillion a day.

New technology has played a critical role in the expansion of finance. For example, computerised trading is said to account for around 70 per cent of financial ‘market activity’ in the US and just below 40 per cent in Europe. High-frequency trading, as it is known, uses algorithms to sell or buy financial assets in fractions of seconds. While in the 1960s, shares were held for about four years, today ‘the average share’ is ‘held for around 20 seconds’.3 Information technology also facilitated ‘credit scoring’ and computational statistical models that enabled mass lending, previously hampered by banks’ reliance on time-consuming personalised credit risk assessments.

In the process, banking changed dramatically. Most no longer fit the vision most people have of a local bank providing services of loans and savings for individuals and businesses. Modern banking involves loans being repackaged, sold and traded, and speculation in global markets. Financialisation has seen the emergence of new types of financial institutions (such as the shadow banking system, or SBS) and practices (for example, securitisation) that are not subject to the same regulations as traditional commercial banks. Shadow banking broadly accounts for $160 trillion assets worldwide, almost half the $340 trillion of total financial assets globally.4 Despite discussion about the need to rein in the SBS in the aftermath of the 2008 financial crisis, it has grown even bigger. The massive growth in speculative trading has led some to describe today’s financial markets as a global casino.

Financialisation has driven the great expanse of debt that has come to define the world economy. In 2014, the consulting firm McKinsey’s estimated that world debt stood at $199 trillion, 287 per cent of global GDP.5

4. What are some of the key processes and practices that characterise contemporary financialisation?

Financialisation includes a variety of practices and processes. Since the end of the Bretton Woods agreement, it has become much easier for money to flow across borders. Domestic restrictions on financial flows have also been lifted. This has meant that banks have found it easier to lend more (increase their assets) and to borrow more (increase their liabilities). The gradual transformation in finance has come from banks innovating in both areas, unlocking ever more liquidity in the process.

Lend first then go to markets to fund it

Banks, like individuals and households, must be able to cover the daily cash balance. To ensure that their customers can always withdraw their cash from a bank, the bank needs to be sure it has cash coming in. This could be met from reserves (our deposits), by borrowing cash from the central bank, or – as became crucial – by borrowing on the open markets from other banks. Previously, many banks managed this balance by expanding the pool of reserves (through a network of branches) and, as necessary, by borrowing from central banks. Since the late 1960s, however, banks have increasingly relied on borrowing on the open market. This has been described as market-based banking and flipped finance on its head: banks now lend first (expanding the asset side of their balance sheets), and then go to money markets to fund their liquidity constraints (the liability side).

Sell now, pay later

Another key change is the rise of securitisation. It was described by a British newspaper, The Guardian, as the ‘crack cocaine of the financial services’ sector. Securitisation is the transformation of streams of future income into a financial security ready to sell immediately. To give one example: rather than wait for year after year for royalties on his records, David Bowie sold a financial security – a Bowie Bond – that investors could buy. Bowie received the money immediately, the investor received the royalties year on year. Securitisation can be applied to anything with a regular income: mortgages, student loans, water services, road tolls, telephone bills, migrants’ remittances, export earnings, wages of a sports star, tax revenues, or even ‘sustainable’ forest management.6 It means that rather than waiting 25 years for a student loan to be repaid, for example, the loan company can sell off the rights to the repayment (at a discount) and get the money back straight away.

This has two main effects. First, securitisation means that financial actors are forever looking for new sources of future income to transform. The game is to find assets and bundle them up in a way that (allegedly, at least) makes their income predictable and steady. Investors in securities like these, however, are essentially speculating: nobody can be sure Bowie will remain popular, just as nobody could be sure that subprime mortgages would be repaid. Second, securitisation means there is no time to waste in issuing new loans. If a bank lends a company £1m and expects £100,000 back a year, rather than wait 10 years for its loanable funds to be replenished, it can sell a security for £900,000 straight away, and carry on lending. This means there is much more liquidity, allowing greater levels of borrowing in the economy.

Future-flow securitisations allow public and private entities access to low-cost credit in global capital markets, detached from official credit ratings and the government’s economic performance (e.g. foreign exchange reserve levels). Proponents of these processes argue that they are based on sophisticated computer models and help to spread and balance risk. However, the assumptions used in these models (based on past prices) do not hold in unprecedented times of crisis when prices of different assets move in the same direction. In practice, these risk-management techniques make financial players act en masse in similar ways, increasing instability and the likelihood of large price swings. The subprime mortgage crisis was a perfect example of the dangers of securitisation.

5. Who are the main actors?

Investment Banks act as market intermediaries, offering financial services to large firms. For example, if a property developer wants to build a number of luxury housing blocks in London, it needs to find the capital to buy the land, sponsor the development, and advertise the investment. To raise this capital, it will go to an investment bank that will help the company develop a financial security and sell this security to investors. Investment banks will often ‘underwrite’ the offerings of these securities. They also engage in ‘trading’, i.e. buying financial instruments for the short term in order to sell on to others. The famous names of banking like Goldman Sachs, Merrill Lynch, Credit Suisse are all primarily investment banks and stand at the apex of global finance.

In contrast, Commercial Banking or Retail Banking was traditionally about taking deposits and lending to consumers and businesses. These are the names more familiar on the high street like HSBC or NatWest in the UK or Bank of America in the US.

From the 1960s, the separation between deposit-taking retail banks and investment banks began to blur. An increasing number of retail banks raised money not from deposits but from the open market. Similarly, investment banks merged with deposit-taking banks so they also had access to deposits. Today’s banks act more like Banking Conglomerates than specialists in either commercial or investment banking.

This mixing of investment and commercial banking had been forbidden in the US by the Glass-Steagall Act of 1933 after the Great Depression. The Act was formally repealed in 1999 but by then financial innovation had already muddied the distinction. After the crisis, President Obama implemented the Dodd-Frank Wall Street Reform and Consumer Protection Act that attempted to protect depositors from the risky activities undertaken by the ‘investment’ side of conglomerate banking activities. Other countries, like Germany, which had traditionally separated retail and investment banking, have found it increasingly difficult to maintain a strict distinction because of the way market-based banking means that banks of all kinds now rely on wholesale money markets as much as customer deposits.

Shadow banking institutions such as hedge funds, mutual funds and structured investment vehicles do not take deposits, but like commercial banks provide credit-type services to other banks and large companies. In that sense, shadow institutions are similar to investment banks, but differ from them since they operate without government regulation and monitoring, in the ‘shadows’. Many regulated commercial and investment banks engage in unregulated shadow banking activities, such as through subsidiaries. Because shadow banks are not regulated in the same way as normal investment and commercial banks, they can often raise and lend money more easily, though with substantially more risk. Shadow banks are, almost by definition, not well-known but include names such as Bridgewater Associates, Vanguard and Cheyne SIV.

Institutional investors are financial firms or organisations – including pension, hedge and mutual funds, investment banks and insurance companies – that trade and/or hold large quantities of financial assets. Institutional investors buy financial securities (bonds and stocks) directly, allowing companies to bypass banks when looking for funding. In the UK and the US, institutional investors now own or manage around 70% of the stock market.7 Institutional investors not only concentrate market power, but also typically have short-term horizons (for example, fund managers are often judged on quarterly performance) and are characterised by ‘herding’ behaviour.8 The biggest institutional investor in the world is BlackRock followed by Vanguard Asset Management.9

Institutional cash pools are an important aspect of shadow banking and institutional investors. The cash that large global companies and institutional funds have to hand – the money that has not been invested in long-term assets – has grown enormously in the last few decades. The volume of institutional cash pools rose from $100 billion in 1990 to over $2.2 trillion at their peak in 2007, before falling slightly after the crisis but then rising again once more.10 This cash has been a key source of short-term liquidity in the financial system. Rather than being deposited in the normal Central Bank-backed banks, it is deposited in the shadow banking sector. It then becomes a key part of the way most banks access money to finance further loans.

Impacts of financialisation on the economy

6. What was the promise of ‘liberalising’ capital flows and what has been the reality?

Since the 1980s and 1990s, many governments began to ‘liberalise’ their capital accounts, removing barriers to the free flow of capital in and out of the country and allowing for full exchange-rate convertibility. According to the United Nations Conference on Trade and Development (UNCTAD), between 1980 and 2007 international capital flows expanded from $500 billion to $12 trillion. During the same time period, foreign exchange (FX) trading (the trading of currencies) grew to become the world’s biggest market. The International Monetary Fund (IMF) and other institutions had encouraged governments to dismantle capital controls, arguing that this would allow for a more efficient allocation of capital and thus encourage economic growth. ‘Developing’ countries, in particular, were supposed to benefit from capital inflows, given that, theoretically, investors would be attracted to the higher returns available in ‘capital-scarce’ economies.

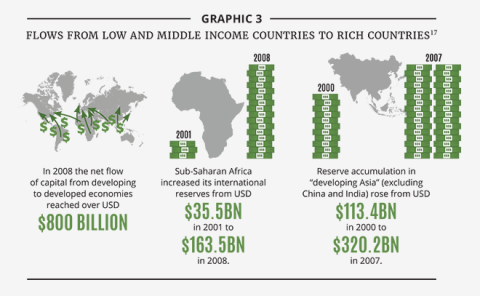

Reality has proved quite far removed from the theory. First, there has been no robust evidence to support the claim that the liberalisation of capital accounts has positive impacts on growth.11 Second, evidence suggests that free movements of capital have resulted in unprecedented volatility of exchange rates, stock market values and interest rates, and therefore greater instability, including a greater likelihood of financial crises. Third, in the 2000s, capital flowed from ‘developing’ to ‘developed’ economies, rather than the other way around.

Short-term speculative interests play a central role in determining the direction of vast movements of global capital and – as such – foreign exchange rates, because flows in or out of an economy can change currency values. Instability can follow as investors move their money from place to place looking for better returns. A hasty influx of capital may whip up a financial bubble, while a sudden outpour can exacerbate or even cause economic crisis. Even in the absence of a crisis, capital inflows can have negative economic impacts, such as currency appreciation, and thus undermine export competitiveness or contribute to inflation), while also limiting national policy choices.

Essentially, countries are vulnerable to crises with external origins (at least partially) beyond their control

Speculation ‘insurance’– how foreign exchange reserves lead the South to subsidise the North

In response to the capital flow and related exchange rate volatility experienced in the 1990s, many countries started to accumulate foreign exchange reserves as a ‘protection’ strategy. These reserves can be used to defend the exchange rate by buying currency on open markets and to counteract other implications of sudden capital outflows; for example, the reserves provide a sort of ‘insurance’ against default on short-term external debt obligations. A large share of these reserves is held as US public debt, reflecting the dominance of the dollar as an international currency and the presumed ‘safety’ of US government securities.

Though China is by far the largest holder of foreign reserves, the trend is evident across Asia, Eastern Europe, Latin America and Africa. As a result of this international reserve accumulation, net flows to ‘developing’ countries were negative between 2000 and 2008. In effect, this means that many low- and middle-income countries (LMICs) became positive net lenders to wealthy countries – principally the US. This reserve accumulation diverts money from productive investment and social spending.

7. How has financialisation changed the economic structure?

Financialisation is a shift in the way wealth is accumulated. Whereas in the past profits came mainly from the mass production and sale of goods, in our financialised era a large proportion of profits come from the buying and selling of financial securities and the interest payments they accrue.13

A 17-country study conducted by the International Labour Organization (ILO) found that the portion of profits represented by the financial sector rose to over 40% in 2005.14 Although the financial sector’s share in domestic profits fell drastically during the first few years of the Great Recession, by 2018 it had recovered. Data from the European Union (EU) shows that non-financial firms’ share of total corporate profits stands today around 40%.15

Financialised accumulation profoundly affects how the economy works. If companies can make more from trading financial assets than by manufacturing products, they may choose not to invest in new technology; or they may spend on expanding their finance department to the detriment of other areas.16 The result is that financialisation has been shown to have a negative impact on ‘real’ investment. The trend is clear: where higher profits can be made through financial speculation, productive investment tends to decline.

It is sometimes argued that financialisation in the Global North simply reflects the shifting of production and manufacturing activities to the Global South, which leaves predominantly financial functions in the ‘home country’ of multinational corporations’. However, Krippner found that US multinationals’ profits from foreign financial activities have increased more than profits from overseas production.17 In other words, US companies appear to be bringing their ‘financialised’ practices with them to other countries. In sum, corporations are not only reaping profits from relocating production to poorer countries, but also increasingly from a boom in financial activities overseas.

8. How are non-financial firms, such as supermarkets, changing in the context of financialisation?

Many non-financial companies have themselves ‘metamorphosed’ into ‘financial rentiers’.18 A retail giant like the UK supermarket Tesco may buy up large areas of land, speculating that rising prices mean it can sell the land later for a profit, without ever building a new outlet. Similarly, Sainsbury’s – another UK supermarket chain – now offers insurance and banking services to its customers. Such is the involvement of large (ostensibly non-financial) corporations in finance that many have their own departments specialised in financial activities. For example, in the case of Enron (discussed below), financial assets were such a central element in the business strategy that the company building had its own trading floor.

Non-financial firms, particularly manufacturing companies, have increasingly relied on financial income streams. According to one study, US non-financial firms’ financial returns (measured by ‘interest and dividend income as a percentage of internal funds’) grew from 20% for most of the 1960s to a high of over 50% from the late 1980s to the early 2000s.19

Around the same period, US non-financial corporations began to invest more in financial assets (like stocks and bonds) than they did in their own non-financial assets (like machinery). Their proportion of financial assets relative to ‘real assets’ increased from around 30% in the 1970s to over 100% in the early 2000s. Various case studies – examining coffee traders, oil companies, agribusiness and car-assembly firms – provide concrete evidence of the ‘financialisation of non-financial firms’ from across the world.20

Lapavitsas argues that corporate financialisation ties in closely with their reduced reliance on banks for credit and their pursuit of profit from unused funds. In other words, corporations seek ways to both lend and borrow money and engage in financial markets directly offering ‘lower costs’ and more ‘flexibility’ than going through banks. Gradually, non-financial firms developed financial ‘skills’ and “acquired functions that previously belonged to financial institutions”.21

Enron and financialisation

Enron Corporation provides an emblematic case of the financialised firm. Originally focused on the distribution of natural gas and electricity, this energy company shifted to a more ‘innovative’ business model based on trading in the financial sector, especially in energy and weather derivatives. The media, academics and market analysts loudly applauded Enron’s creativity until its bankruptcy at the end of 2001. The financialised business model was not sustainable, leading Enron to engage in fraudulent activities. They ‘used legitimate accounting devices for the illegitimate purpose of hiding debt and fabricating earnings’ in order to maintain optimism in the firm and sustain a rising share price, despite Enron’s poor performance. Although the Enron scandal is usually taken to be an example of criminal fraud and governance failure, it is also illustrative of the wider process of financialisation.22

9. How are public services affected by financialisation?

Financialisation has changed the way governments provide public services. Intertwined with the neoliberal revolution, private financial markets have come to play a bigger role in public service provision and financing.

Central to this is a shift from direct public ownership – where the government pays for and provides utilities like water, or services like health care and education – to a system of indirect public provision – where government often partners with private, for-profit providers. Though this involves more bureaucracy and bigger state spending, much of this money is shifted ‘off balance sheet-. Simply put, the debt belonged to the private consortium rather than the state, even though it was taxpayers who would of course be footing the bill. It allowed politicians who did not want to raise taxes directly or borrow more directly to finance new infrastructure. It also hooks private finance into the mix, something that necessarily changes the priority and purpose of public services.

One particularly important way in which public services have been financialised is through Private Finance Initiatives (PFIs). PFIs were started by governments in Australia and the UK in the early 1990s and flourished in the UK under Tony Blair’s New Labour government. In a typical PFI contract, a public authority (such as the UK National Health Service) signs a contract with a consortium of private companies that have responsibility for both raising the money to build public infrastructure (like a new hospital) and operating the service. To finance the up-front cost of building new public infrastructure, the private consortium will take out loans directly from banks. Since private companies borrow from private banks at a higher interest rate than most governments belonging to the Organisation of Economic Co-operation and Development (OECD), this is a more expensive form of financing. The consortium is able to repay its loans, and pay its executive staff and shareholders, from the regular government payments as stipulated in the contract.

In 2018, the UK’s National Audit Office found that PFI contracts will cost government £200 billion over the next 25 years and that the cost of privately financing public service projects can be 40% higher than relying directly on government revenues. In the UK there are currently 716 private finance deals in operation, which cost £10.3 billion for the financial year 2016–17.23 The need to repay the expensive bank loans that have financed the projects leaves the government with few options but to lower costs, something that has seen the stagnation of public sector pay in the UK.

Another public service that has radically financialised is university education. As public sponsorship falls, universities have turned to global capital markets (as well as higher student fees) to obtain finance. Universities such as Cambridge, Cardiff and University College, London (UCL) have started issuing bonds on the open markets.24 Between 2013 and 2018, £4.4bn of UK higher-education bonds were sold into global capital markets. This money is then used to finance building of new university infrastructure and in particular building expensive accommodation (often designed to attract wealthier international students). This has seen the rise in of the rent charged for university-provided accommodation.

This melding of private finance and public services has also affected the provision of social housing in the UK. As the state stopped directly financing the constructing of social housing, private housing associations were asked to carry out the work. As the level of direct government grant for building social housing also fell, housing associations – often acting with developers – have had to borrow directly from capital markets. In order to finance the repayments, housing associations are allowed to charge ‘affordable’ rents – up to 80% of market value – rather than the social rents. This has priced many people out of areas where they had once lived.25

10. What is shareholder value and what is its role in financialisation?

One of the most important aspects of financialisation is also one of the least well understood: shareholder value governance. Over the last 40 years non-financial companies have become obsessed with their share prices and seem to dedicate more resources to improving these than they do improving the products or services they sell. To do so, firms sell off divisions that are less profitable, fire staff, outsource services, and often spend vast sums buying their own shares.

The chase for high share prices and sound creditworthiness has made financial criteria – and financial experts and accountants – central to the strategies companies adopt. Accountants, not engineers, now decide what’s best for industrial companies.

There are four main reasons why share price has taken on more importance.

First there are the shareholders. Equity investors on financial markets have used the stock markets to force companies to prioritise shareholder returns above all other concerns; this is often called ‘shareholder value maximization’.26

If shareholders feel managers are not achieving high enough returns, they will sell the equity and take their money to a company that does. This market pressure is supposedly exacerbated by the fact that ownership of corporate stocks is highly concentrated. If a big institutional investor decided to sell all its shares, share prices could tumble. In this way the stock market – supposedly – left managers with no choice but to obsess about share prices. The reality, however, is that the big institutional funds, apart from a few isolated incidents, have not in fact been able to force their will on non-financial companies. In the UK, for instance, the real returns to equity were just 4.7% in 2015, a rate that has fallen consistently since 1999 and now matches the levels of the mid-1980s, when the focus on shareholder value had only just begun. The trend is similar in the US where dividend yields on S&P 500 listed equity now average little better than Treasury Bills. More often than not, it’s easier for shareholders to go along with management’s decisions than to challenge them.

Second, and more significant, are the managers. In a financialised environment where significant debt can be raised very quickly by issuing bonds rather than shares, managers found it far easier to acquire companies, restructure them and sell off divisions than to try and build long-term plans and improve productivity. Today, many corporations’ main priority is to borrow money quickly and easily, and a high share price is a good route to creditworthiness. They have been backed by management consultancy firms who preach the need to ‘maximise shareholder value’. The chase for high share prices and sound creditworthiness has made financial criteria – and financial experts and accountants – central to the strategies companies adopt. Accountants, not engineers, now decide what’s best for industrial companies.

Third, is pay. Managers have tied their own salaries to share prices by paying themselves partly through stock options. So, when share prices increase, so do their own salaries. Top-brass company insiders – like Chief Executive Officers (CEOs) and Chief Financial Officers (CFOs) – have seen their salaries swell enormously through financialisation. As James K. Galbraith noted: ‘The bosses of the top 350 firms US firms made an average of $18.9m in 2017. That’s a ratio of 312-1 over the median worker in their industries. And a big change since 1965, when the ratio was just 20-1. About 80% of the pay packet is in stocks’.27 Clearly, with their own salaries on the line, there is an enormous incentive for managers to keep share prices high.

Overall, it is clear that financial markets have an enormous impact on corporate behaviour.

Fourth, is demand. The increase in share prices has also been boosted by general demand on the stock markets. This new demand is a result of the massive inflow of funds from households drawn into financial investment through pension plans or special saving schemes. Thus, as Froud et al. point out ‘with financialisation, stock prices are driven by the pressure of middle class savings bidding for a limited supply of securities’. This has made the underpinnings of recent shareholder gains extremely unstable. These authors even liken the operation of the US and UK financial markets to a giant Ponzi scheme: the income of existing shareholders largely depending on the continual entrance of new players.28

Through financialisation the role of the stock market has changed. It is less a place for corporations to raise money, and more a place where managers ‘cash out’ by selling off their equity to investors at inflated prices.

Overall, it is clear that financial markets have an enormous impact on corporate behaviour. In the race to increase share prices many corporate managers have begun to mimic financial market conduct – changing the disposition of the company towards ‘short-termism’. Non-financial firms have chosen to seek new profit channels through financial activities, restructuring (such as outsourcing, takeovers and mergers) and financial engineering (such as share buy-backs or tax dodges), instead of investing in new products or improving productivity.

Social impacts of financialisation

11. How does financialisation affect the household?

As a result of financialisation, households have become increasingly reliant on financial products to meet their needs and wishes. Debt is now a major source of funding for people’s everyday spending, especially in countries like the US and the UK, in the face of declining or stagnating real wages and unstable employment.

In the past, productivity increases were tied to wage growth, which allowed for increased spending and thus demand and growth. Over the last few decades, in contrast, demand (and hence growth) has become increasingly reliant on greater indebtedness. The reliance on loans, especially, has become habitual in many countries, the routine use of credit cards being an obvious example. Increasing use of and access to credit is sometimes treated as a symptom of affluence; however, it can also result from social pressures for maintaining or increasing consumption in vulnerable economic circumstances. Banks too have been keen to speculate on indebted households. Indeed, it was their efforts to turn to household debt as a new source of profit in the early 2000s that led to the financial bubble and consequent crash of 2008, leading to the Great Recession.29

Besides increased debt, households may be involved in financial markets through their insurance cover (health, home, car, life, unemployment), their pension plans, their savings schemes, their student loans and mortgages.

As Montgomerie has described, retail banking innovations have integrated individuals and households into capital market networks even if they are not aware of it.30 For example, by securitising credit card and mortgage debt and selling these securities on international markets, retail banks brought consumers and households into direct contact with investment banking. This made consumer debt a very profitable and apparently secure activity and allowed for an increase in the credit available.

KEY FACTS

- Households in many countries are highly indebted. In 2015 household debt as a percentage of disposable income reached 150% in the UK, 110% in the US, 203% in Australia and 292% in Denmark. A large part of this is as a result of mortgage borrowing.

- In Turkey, debt payments as a percentage of ‘household disposable income’ rose from around 8% in 2003 to almost 55% in 2013 – here the marked escalation was in credit card and consumer, rather than housing, debt.31

The mounting reliance of households on financial markets correlates with the total or partial withdrawal of state support such as pensions, social security, subsidised housing, health, and education. It is about ‘the transfer of risk and responsibility from the collective to the individual’.

Households engage in financial markets not only as debtors, but also as investors. Since the 1980s and 1990s, many governments have been pushing reforms encouraging (for example, with tax incentives) the adoption of private ‘individual retirement plans’. There has been a drift away from ‘pay-as-you-go’ or PAYG (where retirees or pensioners are paid with taxes and contributions from people currently working) towards ‘partially-funded’ or ‘fully-funded’ (in which contributions are invested in a fund, later used to pay benefits) systems. As such, retirement savings have been channelled into financial institutions that have profited greatly from the new income.

Even those countries such as France that maintain relatively large public pension systems have been gradually changing from PAYG to investing state funds in financial markets. At the same time, within companies, there has also been a shift from ‘defined benefit’ to ‘defined contribution’- type plans, which transfer risk from the employer to the employee. Under defined benefit plans, the employer or company provides pensions for its employees. It bears the financial risks and has to pay its workers as promised even when its investments don’t perform as expected. With defined contribution plans, in contrast, individuals hold their own accounts that incur gains or losses depending on investment performance.

In sum, pension reform has converted many workers into investors with a direct stake in the performance of stocks and bonds.

All in all, households have become more closely involved in financial markets, which has implied a cultural transformation in which they are supposed to adopt a ‘finance rationality’. In making decisions about which pension plan to choose, the type of savings scheme in which to invest, between variable and fixed interest rate loans, and so forth, the individual or family is expected to act as a rational financial actor, analysing and calculating the costs and benefits of different options. In short, the individual or household should behave as any other investor. Above all, the individual worker or household should allegedly assume financial risks and take responsibility for their own future.

Indeed, the mounting reliance of households on financial markets is the consequence of a total or partial withdrawal of state support for social functions, such as pensions and other types of social security, subsidised housing, health, and education. It is about “the transfer of risk and responsibility from the collective to the individual”.32 With this in mind, many governments and institutions have been aggressively advocating ‘financial literacy’ for everyone. Neoliberal discourse calls this ‘financial empowerment’. However, the result has been to “naturalize ideas about self-reliance and to depoliticize more specific questions about the privatization of risk”.33

KEY FACTS

How does financialisation affect employment and income inequality?

The effects of financialisation on investment extend to employment. Whereas in the past, new job opportunities and increased productive activity would have been an indication of economic well-being, in the era of financialisation share prices often rise following the announcement of job cuts. For example, in May 2014 Hewlett-Packard’s stock prices rose more than 6 per cent the day after it announced that it would cut between 11,000 and 16,000 jobs.36 Furthermore, many businesses transfer the burden of capital market demands to their workers, slashing wages and adding, in different ways, to the growing precariousness of employment. Real wage growth has been stagnating or declining in countries such as the US and the UK over the last 30 years.37 At the same time, managers and CEOs within the productive sector and top-level financial-sector employees have seen their salaries swell, in large part due to stock option pay and bonuses – contributing to growing income inequality.

KEY FACTS

- One hedge fund manager received US$3.7 billion in just one year of ‘work’, roughly 74,000 times more that the average US household income.38

- US CEOs in the top 350 firms ‘earned’ an average of $18.9m in 2017 – a ratio of 312:1 over the median worker in their industries. In 1965, the ratio was just 20:1.39

If the impacts are negative for labour when finance is ‘doing well’, they are even worse when it isn’t. Workers were the worst affected by the global economic crisis, or Great Recession. Not only did unemployment grow across the Global North, but wealth inequality also continued to rise. Thus, in contrast to the Great Depression when inequality fell because of declining asset values held by a minority elite, in the recent financial crisis asset prices recovered relatively quickly (in part due to the help of government bailouts) and the wealthy got by relatively unscathed.

The difference between the global financial markets and an ordinary casino, as pointed out by Susan Strange, is that people choose whether or not to take risks at the card table, whereas ‘casino capitalism’ drags us all into the game involuntarily.40

13. How did securitisation of mortgages lead to the US financial crisis?

Mortgage-backed securities were at the heart of the 2007/2008 global financial crisis. In basic terms, mortgage securitisation involves a commercial bank selling on a bundle of mortgages to an investment bank, which creates a ‘special purpose vehicle’ or ‘entity’ (SPV or SPE) that pools and then splices the income from these mortgage payments into securities to be sold to investors. Investors choose from securities with different risk levels and corresponding rates of return. The income generated by the mortgage payments are used to pay interest and principal to the lowest risk ‘tranches’ first; high(er)-risk tranches receive payments only if and when the other (preceding) tranches have been paid off.

This is called the ‘originate-and-distribute’ scheme: banks ‘originate’ the mortgages and then distribute them to others. This allows banks to shift credit risk off their balance sheet, plus the proceeds from the sale can be re-loaned onto other customers. Banks may also gain by charging fees for originating the mortgages. The investment bank earns the difference between what it paid for the bundle of mortgages and the amount for which it sells the securities. (In some instances, rather than selling on to an external investment bank, the commercial bank itself creates a SPV in order to conduct securitisation directly.)

US mortgage lending grew considerably between 2001 and 2006. Once demand from the more ‘creditworthy’ segment of the population was met, the market turned to the ‘subprime sector’ or the poorest homebuyers, enabled by securitisation techniques.

As interest rates went up and house prices fell, people start defaulting on mortgage payments. A collapse of the subprime market, on its own, could not have caused a general financial crisis. A large part of the problem was mortgage securitisation: specifically, ‘particles of subprime debt […were] embedded in securities held by financial institutions across the world’.41 Furthermore, a lot of people had taken out extra loans by re-mortgaging their houses on the basis of rising prices (known as ‘equity extraction’), which they were now unable to pay. Finally, many financial institutions had taken positions in ‘credit default swaps’ – a type of derivative seen as a means of hedging potential losses or simply speculating on the performance of mortgage-backed securities and other types of collateralised debt obligations. In this way, the financial system built layers of debt and bets on top of securities that ultimately depended on individual homebuyers paying their mortgages.

The political response of the US Congress to the financial crisis was to pass the Troubled Asset Relief Program or TARP, which provided up to $700 billion for buying up or insuring ‘troubled’ financial assets.42 For Palley, the purpose was not necessarily to save investors from incurring loss, but to prevent a wider crisis, since under financialisation the fortunes of the broader economy depend on the financial system. Despite the US government’s injection of cash, the financial system remained reticent to lend and the ‘credit crunch’ dragged on. At the same time, financial institutions quickly recovered profitability and were not so reticent about paying out large ‘rewards’ to their top employees.

Impacts on food, agriculture and nature

14. How has financialisation shaped food, agriculture and other commodity markets?

From the late 1990s, and especially in the wake of declining returns on equities following the dot.com crash, financial market actors took increasing interest in commodity derivatives. Commodities are raw materials or primary agricultural products, such as gold, oil, copper, coffee, cocoa, wheat, sugar or cotton. (Note that not all primary products are traded on international financial markets.)

Derivatives are financial contracts that derive ‘value’ from the performance of some ‘underlying’ factor, in this case agricultural commodities. There are four main types of derivatives: forwards, futures, swaps and options (see Jargon Buster). A derivative can be thought of as an insurance policy. For instance, if a sugar producer, unsure of the precise output it will have next year, wanted to be able to plan and budget carefully, it could sell a ‘future’ contract to a buyer who agrees to buy a certain amount at a given price. Both the buyer and the producer get certainty. This is something that has long been used to manage risk.

But rather than simply manage risk, financial market actors began to use commodity derivatives to speculate. Investors might choose, for example, to buy a load of futures contracts from an aluminium producer for lower prices today on the ‘bet’ that aluminium prices will increase in the future and they could resell at the higher price and pocket the difference. The increasing involvement of investment banks like Goldman Sachs in commodities led to a scandal in 2013. Goldman Sachs had bought a number of aluminium warehouses and delivery infrastructure. It then delayed delivery on orders to squeeze supply and drive up aluminium prices.43

Historically, commodity prices have tended to change in line with – and thus provide a good hedge against – inflation. This made commodities alluring to those wishing to protect against losses in other investments or to diversify their portfolios. The growing demand for commodity derivatives pushes up their prices, making them even more attractive to financial investors, creating a self-fulfilling cycle.

KEY FACTS

The rapid growth in commodity derivatives trading was facilitated by deregulation such as the 2000 Commodity Futures Modernization Act, which reversed legislation implemented by the US government in the 1930s in response to the Wall Street crash. This, together with other decisions taken by the US Commodity Futures Trading Commission, weakened regulations and opened the door to speculative trading without supervision or obligatory disclosure. This deregulation resulted from lobbying pressures by large financial enterprises.

Just 2% of commodity futures contracts end with delivery of the physical good.

The increased participation of financial investors and speculators has led to changes in the way these commodity markets now work, to a certain extent ‘de-linking’ them from physical market conditions (i.e. actual supply and demand) and tying them more closely to movements in stocks and bonds. For example, index speculators take positions in commodities as an entire group; in other words, they do not usually make investment decisions according to supply and demand conditions in specific physical markets, but rather in relation to the performance of other financial assets. Such speculation is probably behind the simultaneous rise and fall of different commodity prices – not easily explicable by factors of supply and demand. Moreover, speculators have no interest in the commodities as such. According to the Food and Agriculture Organization (FAO), just 2 per cent of commodity futures contracts end with delivery of the physical good.46

The growth of commodity derivatives trading has been strongly backed by many policy-makers and institutions such as the World Bank, which have shifted emphasis from the stabilisation of prices through international commodity agreements, centralised marketing boards and cooperative schemes, to ‘private, market-based, price risk management strategies’47, especially derivatives trading. In practice, participation in derivatives markets is mostly limited to larger players, which do not just use derivatives to hedge physical positions (as a chocolate company might, for example, a futures contract to hedge or protect against the risk of rising cocoa bean prices), but also to derive a growing proportion of their profit from speculative trading.

The main problem with speculation in commodity derivatives is that it contributes to ‘real’ commodity price volatility. Labban argues, for example, that the price of oil is determined – to a considerable degree – by the sale of ‘fictitious barrels’ on financial markets. He shows how oil prices rose by over 60 per cent the first six months of 2008, reaching a high of $147 per barrel, despite a ‘decline in demand and increase in spare production capacity’.48 In other words, changing valuations in derivatives markets – which often do not correspond to the underlying supply and demand conditions of a particular commodity – may be translated into swings in physical market prices.

It has also changed who participates in trading and can benefit from commodity trading. Many small-scale producers and traders, especially in the Global South, who previously used derivatives have now been excluded due to costs and lack of access. Also, their size means they can neither handle the large ‘lot sizes’ required on international exchanges, nor deal with the instability in prices.49 In other words, commodity derivatives apparently no longer even serve the purpose for which they were originally designed, which was to protect the traditional hedgers who have actual interests in the physical commodities.

Financialisation and Inequality in Coffee Markets

Examining the case of coffee in Uganda and Tanzania, Newman argues that financialisation has contributed to increasing inequality in terms of income and power in the commodity chain. Large international trading firms with sufficient funds, access, and knowledge to participate actively in financial markets have been able to gain from price volatility through speculation. Meanwhile, many medium-sized traders were unable to compete financially and went bankrupt or were subject to take-overs. Finally, smaller (especially local) traders and producers tend to lose, as they must accept lower prices in return for stability or the risk implied by volatility.

15. What role did speculative trading play in the world food price crisis in 2007–2008?

The impact of speculative trading on food prices has been particularly severe, though the extent to which speculation was to blame for the recent global food crisis is hotly contested.

The price of ‘internationally traded food’ goods rose by around 130 per cent between the beginning of 2002 and mid-2008.50 These rising food costs were especially difficult for people in the Global South, where food purchases represent 60–80 per cent of income. Following the food crisis, the number of people considered ‘undernourished and food insecure’ rose by approximately 75 million. The crisis led to civil unrest in more than 40 countries around the world and a significant increase in the costs of food imports for the 50 Least Developed Countries’ (LDCs).51

Commodity prices fell sharply after June 2008, in conjunction with the financial crisis, but recovered barely a year later. Kerckhoffs et al. argued that the steady injection (2003 to mid-2008) and then rapid withdrawal (late 2008) of speculative money in commodity derivatives markets was behind the inflation and then sudden bursting of the bubble. Since 2008, prices rose before falling in 2015 and picking up once more. Some argue that commodity prices are stabilising after a period of boom and bust. Yet it is clearly a site of speculation.

16. What is the financialisation of nature?

As financial innovations are used to extend and deepen commodification in ever more areas, it is not just primary commodities, but nature more generally, that is being financialised. Even immaterial ‘goods’ such as greenhouse gas (GHG) emissions have become tradable on financial markets.

The practice of emissions trading emerged in the US in the 1970s as an attempt to limit sulphur dioxide contamination through ‘market’ mechanisms.52 The idea behind ‘cap and trade’ is to create a market for pollution permits. In basic terms: a maximum pollution threshold is established (the ‘cap’ part), forming the basis for the creation of a limited number of permits, which can then be traded.

This trading takes many different forms (e.g. some involve pollution ‘offsets’, where a company can compensate for its own emissions by reducing them elsewhere, such as by investing in a reforestation or a renewable energy project), but the basic underlying principle is the same: to create market incentives for reductions in pollution. Supposedly, more environmentally ‘sustainable’ companies can gain by selling unused quotas, while companies with unsustainable practices lose because they have to pay for additional allowances.

Variations on this theme are used to ‘control’ air and water quality, and similar mechanisms have been designed (supposedly) to halt the exhaustion of marine life by creating tradable fishing quotas or rights.

Once the initial markets have been created, this opens up opportunities for the development of derivatives (e.g. carbon options or proposed fishing ‘catch shares’ futures) that allow companies to hedge against, or speculate on, the prices of these tradable permits, quotas or credits. 53

The financialisation of nature is encouraged by market-oriented environmentalists and by financial actors who see it as a new profit opportunity. However, in addition to debates surrounding the ethics of pricing and commodifying ecosystem ‘services’ and ‘goods’, growing evidence suggests that these financial ‘solutions’ fail to resolve environmental degradation and could actually aggravate the problem, as well as creating new social inequalities by putting the financial sector in control of common resources54 (see TNI’s book: ‘What is Carbon trading and why does it fail?’).

In the case of fishing, for example, ‘financialised’ fisheries management is often based on dispossession – via the creation of privatised fishing ‘rights’ – and exclusion of subsistence fishing communities (see: TNI Primer on ‘The Global Ocean Grab’). Finally, there are fears that new forms of volatility and even crises could be unleashed in the wake of expanding ‘natural capital’ derivatives markets.

Exploring the forces behind financialisation

17. How did financialisation become so dominant?

Financialisation is not something that simply happened. Political decisions or non-decisions permitted the process of financialisation to take off and continue apace. Although deregulation responded, in part, to ‘regulatory arbitrage’ and loopholes that some corporations were already exploiting, policies at the national and international level also actively encouraged activities and changes that buttressed financialisation.

Finally, inaction, such as the refusal to intervene in financial activities that are potentially destabilising, has been at least as important as active policy reform.

Neoliberal policy, in particular, bolstered financialisation.55 The focus in the last few decades has been on removing regulations on capital and corporations. Neoliberal advocates have also insisted on maintaining low inflation, as opposed to the post-war Keynesian era macroeconomic goal of maintaining full employment, which has particularly benefited the financial sector because inflation erodes the value of financial assets.

This agenda was pushed aggressively by national governments (such as during the Reagan Administration) as well as institutions such as the IMF. In the Global South, where it was not imposed by IMF conditions, it still often received backing from local elites. Examining the case of Argentina, Jiménez observes that neoliberal restructuring in the 1990s ‘reflected an alliance of political power between the state and transnational financial power at the expense of industry’. This created a boom in the mid-1990s followed by a bust in 2001.56

Other governments became resigned to such economic policies, arguing that they have little choice in the matter. Once financial liberalisation has taken place and capital is unshackled from its chains, national policy autonomy becomes constrained as countries that fail to comply with investor interests are punished by ‘capital flight’ whereby investors withdraw their money to pursue greater returns elsewhere, or are unable to access private finance as they are no longer judged ‘creditworthy’ by international institutions and rating agencies.

Many economists celebrate the restrictions imposed on public policy through capital mobility; Thomas Friedman, for example, calls this the ‘golden straitjacket’. In this view, capital mobility serves as a ‘disciplinary instrument’, forcing governments to adopt the ‘appropriate’ monetary and fiscal policies such as balanced budgets (which may require harsh austerity measures), low inflation, generous tax codes, and deregulated financial markets.

Ironically, rules of fiscal austerity do not apply in an event of a financial crisis in which the government is expected to bail out private investors and institutions. In reality, market discipline dictates not the desired amount of government spending, but its desired form: budgets which include funds for health, education, or social security, for example, are seen as objectionable, while in the case of a financial crisis the government is expected to empty its purse.

The financial institution bailouts imposed by the US and various European governments following the 2008 crisis are a good example.

18. What regulations were put in place to control financialisation after the global financial crisis?

Financialisation is very deeply embedded into the workings of the contemporary political economy. While many might have assumed that financial crisis would herald a dramatic change in policy and restrictions on the kind of risky practices that led to financial collapse and taxpayer bailout, little has substantially changed.

The biggest shift has been an attempt to agree guidelines to address ‘systemic risk’ to the financial sector as a whole, rather than targeting specific banks or specific practices. The most important initiative has been the Basel III framework, a set of global, voluntary regulatory frameworks which banks are invited to follow. Though they were agreed in 2010/2011 the date of implementation extended into 2019. The rules are largely based on improving the capital that banks hold on their balance sheets. This means decreasing bank leverage (proportion of debt to equity) and ensuring bank hold a greater proportion of low risk assets.

In Europe, there was a political effort in the immediate aftermath of the financial crisis to adopt a Financial Transactions Tax (FTT) on certain kinds of financial securities, and to restrict the growth of asset-backed securitisation. These were pushed in particular by the European Parliament. Yet the European Central Bank (ECB) and the British government thwarted both and instead actively helped to rebuild an Asset Based Securities market and other securities markets that were supposed to be a target for an FTT.57

The shadow banking sector – despite its role in the financial crisis – has been largely untouched. It continues to boom. The Financial Stability Board reports that the share of financial assets held by non-deposit-taking institutions reached almost 50 per cent in 2016. China is a particular cause for concern; its shadow banking industry is now worth $15 trillion, or about 130 per cent of GDP.58 The IMF, in a 2017 report on shadow banking, noted that ‘risk has… shifted towards corners of the financial system where we have less visibility and fewer instruments to deploy’.

19. Why did the financial crisis lead to financial sector becoming more powerful?

Financialisation can be changed only by social movements that work to transform it. Though there have been important pockets of resistance, nothing as yet has been able to counter the power of the oligopolistic banks, asset managers and politicians that have gained so much from financialisation. There are three key aspects to the power of finance.

First, direct power over policy-makers and regulators. The financial industry is huge, complex and has access to financial and informational resources, well out of reach of any other social class. In the run-up to the last US presidential election the financial sector spent $2 billion, including $1.2 billion in campaign contributions – more than twice the amount given by any other business sector.59 A 2016 report by the Corporate Europe Observatory found that the UK financial sector spends over £30 million per year on lobbying in Brussels and employs more than 140 lobbyists to influence EU policy-making.60 Alongside these basic financial resources, the complexity of the financial sector gives it an informational advantage over regulators and policy-makers. Together this makes it hard for politicians to impose regulatory changes that would restrict the growth of financialisation.

Second, structural power over society. In a context of capitalist overproduction and decline in profits among OCED countries especially, debt-led growth is often the only way governments can raise the tax and borrowing needed to finance public spending and produce the growth rates necessary to satisfy citizens. The growing reliance on debt means that, regardless of what politicians may really want, they need financialisation to continue. This greatly empowers the two dozen or so investment banks at the centre of credit creation and is precisely why since the crisis new avenues of speculation have emerged like a bubble in collateralised subprime company debt.61

Third, infrastructural power. The final way in which finance retains a hold over society is that private financial markets, in particular the securitisation market are used by central banks to implement monetary policy.62 That means in order to ‘govern the economy’ as a government must do, it must rely on private financial institutions. This gives the financial sector the power to resist changes.

The Enron Lobby

Froud et al.’s case study of the ‘financialised’ US Enron Corporation is instructive in how politicians have with impunity colluded with corporations to support risky strategies of financialisation. Enron’s senior managers were from the Texan elite, with strategic national connections. Kenneth Lay, the CEO of Enron, was an expert lobbyist. Enron made donations to both political parties. These connections helped Enron push for deregulation of the energy sector, especially in relation to financial trading.

For example, in 1993 the Commodity Futures Trading Commission (CFTC) exempted energy derivatives from government supervision. The Chair of the Commission at the time was Wendy Gramm, who left her position after making this decision and a few weeks later became a member of the Enron Board. Enron was also behind legal reform “which limited the amount that companies would have to pay out as damages in the event of conviction”.

When Enron went into bankruptcy at the end of 2001, the same people who had received generous offerings from the firm were expected to investigate the company for fraud – 212 of the 248 Senators and members of the House of Representatives involved in committees investigating Enron’s collapse or the conduct of Andersen (Enron’s accounting firm) had received donations from one or both companies.

Resisting financialisation

20. What is ‘financial democracy’ and why is it problematic?

The growing involvement of ‘ordinary’ people in financial markets is sometimes celebrated as the dawn of a ‘financial’ or ‘investor’ democracy. Wealth is supposedly constantly redistributed from corporations to the millions of worker-cum-shareowners. Policies that favour Wall Street or the City now allegedly represent the public good rather than serving a narrow minority.

Yet only a small percentage of the population is able to invest enough savings for financial gains to be truly relevant. The impression made by the statistic of more than half of North Americans having a ‘stake in’ the financial markets quickly deflates given that 40 per cent of shareowners hold only ‘negligible’ amounts in shares. Put differently, 70 per cent of US households own few or no stocks.63 In sum, most people do not benefit in a significant way from rising share prices or increasing dividend payments. Furthermore, the notion of financial democracy distracts from the fact that the sector is actually highly concentrated. If before the crisis many institutions were considered ‘too big to fail’, this only worsened with restructurings: by 2014 just five investment banks controlled 44.61 per cent of US financial assets.64

Still, the mere impression of financial democracy, regardless of the fact that it is not backed by the figures, consolidates the hegemony of finance: ‘As investors, many workers now appear to have a direct material interest in neoliberal policies such as capital mobility, price stability, low capital-gains tax and shareholder value’.65 In reality the losses suffered by the majority under these policies are far greater than the measly gains obtained from them.

The financial democracy thesis is also questionable given that workers and large corporations are clearly unequal in the finance game. Most big firms cannot easily be taken advantage of by financial institutions since they have a similar level of power and access to information, but individuals often use finance to meet basic needs and may have few alternatives. For example, a company may take out credit as part of a calculated leveraging strategy in order to multiply gains, while an individual may have little option but to take on a student loan or use a credit card to pay for groceries. Furthermore, workers continue to be mere consumers of financial products, while large firms have the capacity not only to buy in the financial markets, but also to sell. Finally, ‘limited liability’ gives corporations exceptional power compared to the individual household: unlike workers, shareholders’ homes are not seized in order to pay the debts of an insolvent company. There is clear evidence of this inequality if we look at the outcome of the Great Recession: many families lost homes and jobs, while governments used public funds – namely, tax revenue – to rescue many companies.

For Bryan, Martin and Rafferty, far from constituting a ‘financial democracy’, financialisation can be likened to an ‘enclosure’ of the household: ‘the realm of reproduction and domesticity’ has been converted into ‘a scene for further accumulation’. In many cases, households are forced to work more (for example, taking on extra jobs or doing overtime work) in order to sustain growing levels of debt. As argued by Lapavitsas, there is an evident contradiction at the core of this phenomenon’: the growing reliance of banks on extracting profit from workers’ income corresponds with stagnating real wages.

In practice, ‘financial democracy’ has meant the money of the many fuelling the profits of the few.

21. How can financialisation be resisted?

Financialisation has imposed new pressures on everyday life and made old pressures worse. But it has also opened up new possibilities for resistance. One is debt itself.66 Just as striking coal miners in the UK used their access to the engine of the economy at the time – coal – to flip the balance of power and demand better conditions, so now debtors can use their access to credit by declaring a debt strike. A refusal to accept unfair quantities of debt lumbered on people in financialised economies could force creditors to back down or change their terms of payment. In early 2015, a group of 15 US students refused to pay back the student loans they took out to attend the for-profit Corinthian colleges. Outstanding student debt in the US is over $1 trillion and organisations like Strike Debt and the Debt Collective hope to organise mass refusals to help counter the debt-laden financialised norms they live under.

Refusing repayment and demanding a write-off of debt has a long history. Anthropologist David Graeber’s thorough history Debt: The First 5000 Years shows how debt jubilees have been common since the debt slates were wiped clean in ancient Mesopotamia.

Another route of resistance is the attempt by campaigners to foster solidarity and a sense of collective identity among debtors. Rolling Jubilee, a collective that grew out of Occupy Wall Street, is using the financial markets to this end. It is organising debt jubilees by collecting donations to buy distressed personal debt (money that banks have given up trying to collect) at discount on the secondary debt market. Instead of allowing it to fall into the hands of debt collectors, the group steps in, buys the debt and writes it off. Those who have had their outstanding loans cleared are then encouraged to donate to keep it moving. Because the debt is worth much less than the value of the initial loan, they are able to buy up large quantities. By August 2018 Rolling Jubilee had raised over $701,000 to write off almost $32 million of distressed debt. They hope that such actions will make even more radical debt strikes possible.

Another way to exercise pressure on large banks is by moving your money to smaller institutions with different operating logics. The Move Your Money campaign created a ‘Bank Ranking Scorecard-, which ranks UK banks and building societies according to criteria including ‘honesty, customer service, culture, impact on the real economy and ethics’ in order to help people decide where to open an account.

Crowdfunding and peer-to-peer lending, in which individuals lend or donate directly to the project or enterprise of their choice, is also a means of bypassing large financial institutions. However, the growing popularity of these schemes puts them at risk of corporate takeover; in this sense, it is worth investigating how different platforms operate before jumping on the bandwagon.

There are also a number of different campaigns aimed at addressing the problems wrought by financialisation. Most of these campaigns focus on lobbying governments to regulate specific aspects of the financial industry. For example, the US ‘Stop Gambling on Hunger’ and the European campaign against ‘Food Speculation’ (which combines the work of a number of civil society organisations (CSOs) and NGOs) have been pressing for the introduction of new rules to reverse the financialisation of agricultural commodity markets. The latter campaign contributed to the EU’s decision to impose position limits, capping the number of contracts on agricultural commodities that any one financial trader or group of traders can hold. Unfortunately, opposition to the regulations, especially from the UK government, watered down the agreement and left key loopholes open.67 There are also multiple campaigns for implementing or strengthening more general financial transaction or Tobin taxes, aimed at stifling speculation.

We have outlined just a few channels through which financialisation is being challenged. Throughout history people have responded to coercion in creative and unexpected ways. Just as financialisation is a recent historical phenomenon, so resistance to it has only just begun.

Jargon Buster

What an individual or company owns is their ASSET. A house is an asset, as is crude oil. Financial instruments – such as stocks and bonds – can also be considered assets. People and companies can use assets as the collateral for a loan. Yet if asset prices fall, then the value borrowed may be more than the value of their property and they could face bankruptcy if they can’t repay their loan.

In the CARRY TRADE firms borrow in one currency at a low interest rate in order to lend or invest in another with a higher interest rate (to profit from the differential). Because interest rates tend to be higher in ‘developing’ countries, these have become a key target in the carry trade, especially those with appreciating currencies (a tendency reinforced by the inflow of capital caused by the carry trade). If, or when, the carry trade – and, as such, the inflow of capital – is reversed (perhaps due to a sudden loss of confidence or a rise in interest rates in the funding country) it can cause enormous upheaval – with some actors suffering bankruptcies while others, such as hedge funds, profit. The Asian debacle of the late 1990s is the most cited example of the destructive impact of a carry trade ‘unwinding’, but it also played a role in the 2008 global financial crisis.68

CURRENCY DERIVATIVES – the majority of foreign exchange (FX) trading is accounted for by Over the Counter (OTC) derivatives contracts. Since the collapse of the Bretton Woods system, an increasing number of countries have abandoned fixed or pegged exchange rates and allowed – at least to a certain extent – the value of their currencies to be determined by market supply and demand. This implies constant fluctuations in exchange rates, which pose risks for firms across the globe. These companies may use FX derivatives as a sort of insurance (a way to ‘hedge’) to protect themselves them from potential losses due to swings in the exchange rate. However, many investors use FX derivatives not as ‘insurance’ or a protection strategy, but rather to place bets on particular currency movements.

In a CREDIT DEFAULT SWAP (CDS), for example, the seller promises to pay the buyer for the value of a debt if the debtor defaults. For this, the buyer must pay the seller premium instalments. Unlike conventional insurance, it is not necessary for those involved in the derivative exchange to have any direct interest or involvement in the underlying debt. In short, using CDS derivatives, speculators external to a particular credit contract can make bets on the likelihood of default. These became very popular instruments during the financial bubble and played an important role in the crisis. Between June 2005 and June 2007 the notional amount outstanding in CDSs rose from just over $10.2 trillion to $42.85 trillion.69 A few years before the crisis, Alan Greenspan, head of the US Federal Reserve, celebrated the development of the CDS market, while government ‘financial experts’ prevented these innovations from being regulated.

DERIVATIVES are financial contracts that derive ‘value’ from the performance of some ‘underlying’ factor. This underlying factor doesn’t even have to be a ‘thing’: for example, weather derivatives allow one to hedge against or speculate on hurricanes, frost and snowfall, or the amount of sulphur in the air. Unlike securities, which imply a claim on future income streams, derivatives represent an ‘exchange of performance exposure, where gains and losses are expressed simply in the changing price of the derivative itself’.70 Most derivatives contracts are officially considered risk-management or hedging tools. Ironically, the use of derivatives to hedge against volatility has itself become a source of volatility, while speculation on derivatives markets depends on volatility for profit making. There are four main types of derivatives: forwards, futures, swaps and options.