Holding the strings The role of finance in shaping Big Tech

The power of Big Tech can not be understood without examining its financial backers. Venture capital has encouraged hype and speculation and motivated platforms to monopolise audiences and squeeze workers’ pay and rights.

Illustration by Anđela Janković

‘Web3’ has surged onto the agenda of Silicon Valley’s founders and financiers. The newest libertarian tech paradigm vaguely promises the decentralisation of the internet – using technologies such as blockchain - to save it from the clutches of current platform corporate control. A year since this hype, its track record is at best mixed. But besides hacks and lacklustre engagement from the general public, insiders have identified a more profound problem with the next big thing in tech. Jack Dorsey, the co-founder of Twitter, pinpointed why the optimism of those boosting decentralisation is misplaced. On 21 December 2021, he tweeted: ‘You don’t own “web3”. The VCs and their LPs do. It will never escape their incentives’.

Venture capitalists (VCs) and their funders (limited partners, or LPs) receive little attention in the contemporary debate about digital power. Yet highlighting the financial actors behind tech revolutions is long overdue. How did Uber operate for almost a decade without making a profit? Why did Google create its advertising business in the first place? How did Facebook (now Meta) fend off its early competitors? Building and maintaining a platform is immensely expensive. Whenever we try to get to the bottom of digital power and start tracing the steps that companies took towards becoming so dominant, we need to address the question: How was this financed?

Venture capital is a high-risk, high-reward form of investing. Most investments fail, but a small number of highly successful ones generate outsized returns. A famous example of this is the VC firm Benchmark’s original investment of $12 million in Uber, which rose to a value of $7,000 million. Venture capitalists, in turn, raise the money they invest from pension funds, endowments, insurance companies, corporations and high-net-worth individuals. Upon their investment, these become LPs of a VC fund.

Financiers are far from neutral intermediaries that merely allocate capital. They face pressures to make returns for their stakeholders and shareholders, and are actively involved in shaping the world around them to accommodate their financial aims. Few major tech companies reach their scale without VC funding. Prominent examples are Amazon ($8 million received in VC funding), Google ($36 million), Facebook ($800 million), Airbnb ($2,444 million) and Uber ($6,523 million). Given the magnitude of these cash injections, it is highly doubtful that it is even possible to build a large tech business without VC financing. How could any individual entrepreneur compete with a company that can draw on funds like this? And if you can’t, shouldn’t finance take a much more central role in our analysis of digital power?

Put simply, if we want to understand digital power, we need to understand how it is financed. Digital power, after all, is embedded in a financialised economy. Ignoring the financial pillars of the platform economy risks missing how Big Tech affects us beyond the nature of work and privacy concerns. As this essay will show, financialised elements of everyday lives, from pension and insurance contributions to loans, are tied up with the fate of Big Tech.

We can learn a lot about the functioning of today’s publicly listed Big Tech companies by studying their private market beginnings. I will not focus on the already established Big Tech companies like Amazon, Alphabet, Apple and Meta. Once companies have gone public, VC firms lose most of their influence over them. Yet for the crucial period between incorporation and going public in the stock market, these financiers play a critical role in shaping emerging tech companies. Understanding how the next generation of Big Tech companies is made can help inform our ability to safeguard against their power. By focusing attention here, this article aims to develop tools to understand and resist Big Tech as it unfolds.

Financing the Tech Boom

Larry Summers famously argued that since the early 2000s, Western economies are caught in a state of ‘secular stagnation’. This describes a state where excessive savings drag down demand as they are not being spent and generating new income. As others have shown, runaway wealth increases have led to substantial growth in savings among the top 1%. Excessive savings here reflect rampant inequalities in income and wealth distribution. In addition to that, Summers explains that digital platforms conserve capital by further encouraging savings: ‘Think about Airbnb’s impact on hotel construction, Uber’s impact on automobile demand, Amazon’s impact on the construction of malls, or the more general impact of information technology on the demand of copiers, printers and office space’. The results of these two developments are low investment, low growth, a lacklustre recovery from economic downturns, and a capitalism devoid of dynamism. This is the financial backdrop against which the rise of the platform economy needs to be read.

This development became especially problematic after the 2008 Global Financial Crisis. Governments and central banks were tasked with containing the crisis and charting a recovery from what would become known as the ‘Great Recession’. The key responses were fiscal austerity and expansive monetary policy. Major central banks like the Fed, Bank of England and the European Central Bank (ECB) lowered interest rates to near zero. Concurrently, central banks also deployed quantitative easing (QE) programmes. Leaving most technical details aside, this meant that central banks started purchasing government and corporate bonds, which in turn raised the price and lowered the interest on those bonds. The intention was to spur investment and economic growth by making it cheaper to take out credit.

In effect, QE made it harder for many investors to rely on interest payments to make their desired returns. This was particularly true for institutional investors like pension funds, endowments, and insurance companies which increasingly scrambled to find profitable outlets for their capital, throwing them into the arms of the big asset managers like BlackRock. If significant growth was achieved in this environment, it came through capital gains on equity markets. This saw a debt-fuelled conversion of savings into unsustainably high investment levels. The flood of cheap capital further drove down yields on bonds and raised the yields on equities. In other words, buying the debts of governments and corporations (bonds), a proven but increasingly insufficient strategy for institutional investors, was supplemented by purchasing corporations’ shares and stocks (equity).

This resulted in a decade-long bull market in publicly listed Big Tech stocks, and privately held shares of tech startups, where asset prices continuously rose. ‘Unicorns’ – private companies with a valuation exceeding $1 billion – became the highly publicised figureheads of the seemingly unceasing upward trajectory. In the UK, the number of unicorns increased from 10 in 2010 to 80 in 2020. As was the case with excess savings, this shows that macroeconomic trends, finance and the fate of Big Tech are closely intertwined.

The Venture Capital–Platform Nexus

Venture capitalists buy minority stakes in early-stage, private companies. Typically, VC investors sit on these companies’ boards and actively advise and consult them. They are particularly known for financing the next tech generation. For that reason, venture capital is often considered ‘patient’ because investors have to commit for up to a decade before they can expect a payoff. The only way for VC investors to realise their gains is when the investee company is either acquired (usually through some form of merger and acquisition) or goes public on the stock market through an initial public offering (IPO). In the case of Uber, ten years passed between incorporation and the IPO. Their ‘patience’ notwithstanding, VC funds usually have a limited lifetime, which means the understanding between investors and startups is that the latter have to pursue ambitious growth rates to scale up quickly.

In order to make returns, institutional investors increasingly turned towards riskier, alternative outlets for their capital. Venture capital stood to be a major beneficiary from this dynamic. The relationship between institutional and VC investors can be imagined as being like a chain of investments. Institutional investors conservatively manage very large investment portfolios. The returns they generate finance pension plans, insurance benefits, endowment expenses, or simply make rich people even richer. Venture capital funds handle much smaller volumes and portfolios, with an inverse risk–reward structure. They act as an intermediary between institutional investors and unproven tech startups, absorbing the risk mismatch and directing money into opaque private markets.

Besides macroeconomic push factors, the characteristics of venture capital further provided a pull for surging investments into their funds. VC firms are primarily invested in tech-related businesses, one one of the few sectors that still generated growth in a largely anaemic phase of capitalism. Moreover, the VC industry understands how to sell their highly publicised successes. The most successful VC firms generate returns way above what the stock market could offer. As a consequence, venture capital saw steep increases in funding volumes from the late 2000s. In 2020, VC investment in tech companies in the UK stood at $14.9 billion. This is still dwarfed by the US venture capital market, where investors dished out $144.3 billion. Globally, VC investments increased from $59 billion in 2012 to over $650 billion in 2021.

On the back of cheap money at VC investors’ disposal, new types of business models drew their attention. The dress rehearsal for today’s platform economy was the 1990s’ ‘dot-com’ boom, where e-commerce businesses pioneered many of the ideas that a decade later would become common sense. The dot-com bubble (and eventual bust) are often ridiculed for the laughable business ideas that were brought to public markets at sky-high valuations. Yet the business models and financing of companies like Pets.com (which delivered pet supplies ordered online) were not radically different from those of today’s platform giants.

The platforms’ business strategies depend on investors who are willing and capable of shouldering year-long financial losses. By mutual agreement, platforms such as Uber are losing money because they prioritise rapid growth (or scaling) over profitability. Platforms pursue different strategies to supercharge their growth. On the one hand, there is user-driven growth through what are called network effects. Platforms’ digital intermediary position between different user groups means that they create networks of users. Network effects occur when the value of the service or product the platform offers increases as more people start using the platform. For example, the value of using Instagram increases as more users sign up (direct network effects), and the value of hailing rides or driving for Uber increases as each group grows (indirect network effects). At some point, network effects essentially become a natural monopoly, similar to broadband infrastructure or railway systems, where users are increasingly locked into the service while competitors find it ever more difficult to enter.

Alternatively, or ideally in addition to that, platforms can burn through investors’ cash by doubling down on their expenses. They can use investors’ money to acquire customers, such as through discounts or advertising. Through VC-fuelled growth, platforms can drive out competitors and fortify their ‘moats’. Rather than an option, rapid growth is a necessary condition for many platforms to operate profitably at some point in the future, because profitability hinges on dominating the market.

In a nutshell, the platform model is built on large amounts of ‘patient’ capital that finance rapid scaling of platform operations. Network effects are a potent tool to advance this process. More than just desirable, market domination is a necessity for platforms to be sustainable – and for their VC investors to make sufficient returns on their investment. This was enabled by the post-2000 low-interest macroeconomic environment, which created conditions that sustained platforms for years without making any profits. While this funding arrangement predates the internet, digitalisation charged the speed and scale of investee companies’ expansion.

The important takeaway here is that financial and platform capitalism are deeply entangled. The rise of platforms fulfils a function within a larger search for returns for investors. Institutional investors’ problem of low returns was ‘solved’ by funnelling money towards VC funds. VC investors flocked to platforms for their ability to put to use large amounts of cash and little likelihood of very large returns. In turn, the availability of this capital pushed Big Tech into models that looked to become dominant and lock out competitors. The flipside of excess savings was a VC-led investment regime for which platforms became an ideal outlet. Finance plays a substantial role in who gets to advance in the digital economy, and digital power boils down to the power of finance.

Digital Power through the Financial Lens

Examining emerging platforms through the financial lens allows for a different reading of the current situation. Alphabet, Amazon and co. absorb most of the public attention. Yet dozens of platform startups currently attempt to carve out space for themselves and ‘disrupt’ legacy sectors. It seems that every year, investors’ attention focuses on a new hype. A few years back, ride hailing inaugurated this tradition with a fierce standoff between Uber and Lyft. Since then, food delivery (JustEat, Uber Eats, Deliveroo), micro mobility on rentable bikes and scooters (Bird, Lime, Bolt), and challenger banks (Monzo, Revolut, N26) have joined the trend. More specifically in reaction to the pandemic, fast grocery delivery (Getir, Gorillas) and office collaboration tools have been swamped with investors’ cash.

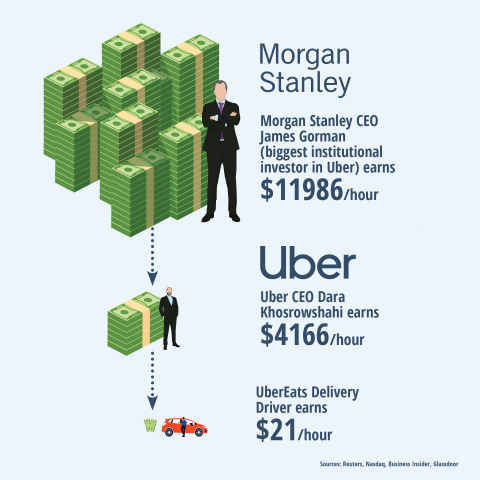

Each of these was presented to the public as a revolutionary change in how the economy and society operate. Uber is arguably the most prominent case here. While this is difficult to remember after years of corporate scandals regarding Big Tech, when it started up, Uber was mostly welcomed as a harbinger of the ‘sharing economy’. For a brief moment, there was a genuine belief that platforms could usher in a more democratic, sustainable capitalism by letting people share their underused assets. On the back of this narrative, Uber raked in more than $6 billion in VC funding over coming years to self-fulfil this prophecy. Its list of investors reads like a Who’s Who of private market investing, including the VC firm Benchmark, SoftBank’s seismic Vision Fund and Saudi Arabia’s sovereign wealth fund, The Public Investment Fund.

With its ‘war chest’ filled to the brim, Uber embarked on the typical platform strategy I outlined above. As the Uber files have more recently revealed, employees opted for aggressive strategies to drive legacy industries (i.e. taxi drivers) out of business. Competitors were challenged on price, where Uber could afford to set fares below cost to increase their market share. To keep network effects going, the company was also able to use investors’ money to uphold eyewatering acquisition costs. At one point, the company paid drivers a $750/$750 referral bonus: Give new drivers $750 for joining and $750 for the person who referred them. As the former Uber executive Andrew Chen boasts, ‘we spent hundreds of millions just on driver referrals programs, and nearly a billion in paid marketing’. In light of these strategies, Uber’s infamous unprofitability comes as no surprise.

While in its early days Uber seemed almost unstoppable, a more sober look begs the question what would be left of its digital power without the lavish financial backing. ‘Uber Technologies Inc’ is the company’s official registered name, yet what substantial changes did its technology effect? Granted, Uber built a sleek app with a good user interface. But this didn’t solve any of the problems that taxi services have always been dealing with: empty backhauls caused by uneven geographic demand, the high cost of peak capacity or the risk of overcapacity. The is emblematic of the wider platform economy, where a thin layer of tech often disguises the reality that platform companies are simply restating rather than solving long-standing problems.

So why are platform services so popular with consumers? In this reading, demand for platform services is largely explained by the price distortion that VC money enables. This means that at the outset, services are either free or unsustainably cheap. It’s not all that surprising that people love free stuff. But demand at the ‘real’ price of the service that consumers will have to pay in the long run will inevitably be much lower. The challenge for the platform, then, is to damage competitors and engrave themselves in people’s desire for convenience before they reach that point. As VC funding and the proceeds from Uber’s IPO start to run out, the company has started raising prices steadily.

A similar story has played out across different industries. Micro mobility platforms covered European cities in rental bikes and e-scooters, much to the dismay of local residents. When we start to pierce through the narratives of easy access, sharing and convenience, many of these companies look more like an act of desperation to will the ‘next big thing’ into being. This points to the limits of financially enabled platformisation. These limits now become increasingly obvious because of changing macroeconomic conditions. High inflation and rising interest rates have reduced the flow of cash into highly risky startups. With investors inclined to see positive cash flow instead of high ‘burn rates’, a number of ‘disruptors’ were thrown into disarray. A prominent example of this is the fast grocery delivery sector, where Gorillas laid off hundreds of workers and pulled out of four countries. Even the Tech Giants Meta, Alphabet, Amazon and Twitter weren’t spared and a layoff tracker estimates the number of jobs cut at over 130,000.

Looking at the current state of emerging platforms through the financial lens challenges our conceptions of digital power. New services that are sold to us as a revolution in transport or shopping begin to look like investors’ desperate attempts to make returns in a low yield environment. The ability of Uber, Bolt and Gorillas (to name but a few) to turn their shaky business model into a self-fulfilling prophecy hinged on torrents of capital from their VC investors. And these huge streams of capital were a function of a global economy awash with cash. The point here is that many platform services exist only because an abundance of capital needs to be channelled somewhere.

De-financialise to de-platform: Implications and Resistance

We can’t talk about digital power in isolation from the financial power behind platforms. This new angle reveals new dependencies as the change of macroeconomic tides in 2022 has put many tech companies under pressure. Rising inflation rates have prompted central banks to raise interest rates. This was immediately felt by investors who adopted a more conservative approach to high-risk investments.

This is not a reason for schadenfreude, however. If we follow the chain of investors, the slowdown in tech will have ripple effects for society at large. When money was cheap and markets were going up, startups kept VC investors happy. Rising VC portfolio values meant better returns for their LPs, the pension funds, insurance firms, endowments, etc. This ultimately ensured the viability of defined contribution pension schemes and insurance plans. Institutional investors allocate only a small share of their portfolios into risky asset classes and will not be drastically affected by the downturn in tech. However, it is important to note how our everyday decisions are linked with high finance.

Although venture capital is a highly speculative form of investing, investment decisions have concrete effects in the present. There are now significant sums of money tied up with companies that exist by burning through VC investors’ cash. Irrespective of unsustainable financial strategies, platforms have inflicted lasting damage on competitors or legacy industries. Transport companies like Uber are an obvious example, and a similar case can be made for the effects of accommodation platforms on hotel chains (and family hotels), the impact of social media on newspapers, and streaming platforms’ disruption of the music and film industries. In their absence, we might find ourselves in a position where we are lacking access to important services.

And beyond the platform–consumer relationship, platforms might also depend on each other: As many startups are each other’s customers, one of them going bankrupt has potentially systemic consequences. Cryptocurrency exchanges are a case in point. An extreme example of this is what the Financial Times dubbed the ‘Tesla financial complex’ with regard to its outsized impact on the stock market. This describes a ‘vast, tangled web of dependent investment vehicles, corporate emulators and an enormous associated derivatives market of unparalleled breadth, depth and hyperactivity’.

The upshot here is that if we want to de-platform and scale back digital power, we would first have to de-financialise. Digital power is the product of a distinct financial regime. Yet scaling back financialisation is a task of a much larger order of magnitude. Fiscal, monetary and legal changes that enabled financialisation more broadly, and encouraged flows of money into the VC industry more specifically, are tied up with a broader desire to reignite growth in stagnant economies. Curbing these flows would give rise to the need for a credible alternative growth regime. So, what can be done about this?

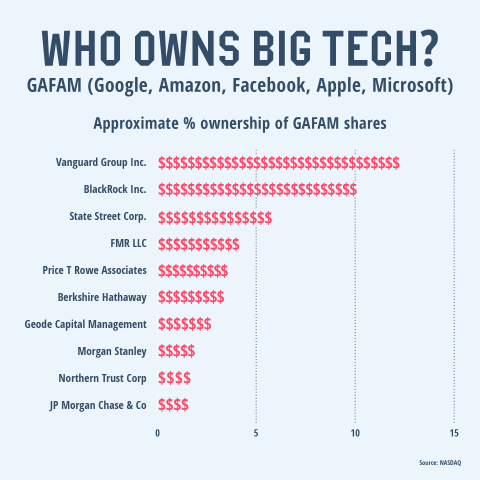

Despite being a tall order, challenging the power of established financial regimes is not without precedent. More recently, and especially with regard to the climate catastrophe, activism has focused much more squarely on financial actors implicated in this development. Activist research has revealed how asset managers like BlackRock, Vanguard and State Street amassed power through concentrated share ownership. BlackRock alone currently has $10 trillion under management. The company has put this money to use by purchasing shares in publicly listed companies. As significant shareholders in corporations across the entire economy, asset managers like BlackRock effectively indexed the market, by constructing a portfolio that tracks the performance of large parts of the economy. In other words, when the market goes up, so does BlackRock’s portfolio. A ‘side effect’ of this is that BlackRock as shareholder has a say in corporate governance decisions of a vast amount of companies. How this power is used and to what ends has become increasingly politicised, as activist campaigns seek to coerce the asset managers into matching power with responsibility.

Challenges to asset manager capitalism show a way forward for resistance against the VC-led investment regime. Public market scrutiny needs to be combined with more attention to what is going on in private markets. Interestingly, a few major VC investors have started to mimic the indexing strategy of the big asset managers. For instance, Tiger Global and Softbank’s Vision Fund have embarked on acquiring shares in a very large number of private companies. Due to more lenient reporting requirements, private markets are more difficult to scrutinise. Yet a concerted effort to gather what is publicly available would help to paint a much clearer picture of the investment landscape.

Further, we need a better understanding of what institutional investors supply capital to the VC industry. There remains a lot of work to be done in mapping such relationships and following the investment chain from institutional investors to VC funds to startups. Some institutional investors have public reporting requirements, which could be a starting point and further provide insight into the actual financial performance of VC funds.

Rather than reacting to existing crises, a focus on the financial actors behind Big Tech enables us to anticipate where future problems might emerge. If we want to see what’s next, we should be looking at what kind of funds VC firms are raising, what their purpose is, and what companies are found in the portfolios of the most successful VC funds. This might give a hint to which industries will face pressures next and where the nature of work is about to undergo a major transformation. For instance, there have long been attempts to bring white-collar services under a platform labour system. Preparing for the impact might give workers an edge to organise and anticipate the coming disruptions.

The changing macroeconomic environment does promise change. What kind of change is impossible to say at this point. Challenging digital power starts with changing the supply of capital, and this is profoundly affected by tightening monetary policy. While this is largely beyond activists’ control, historical lessons might be drawn from comparable episodes. Jack Dorsey’s annoyance about the trajectory of web3 should be turned into an activists’ rallying cry. At the heart of the desire for decentralisation is a yearning for the early internet, to restore web 1.0’s noble ambitions before the web 2.0 corporate capture. This has progressive potential. Understanding the incentives of VCs and their institutional investors LPs can lead the way to challenge digital power and realise it.